Digital Earnings & Financial Returns Insights

When you think about digital earnings, income generated through online financial tools like investing, crypto, and digital assets. Also known as online financial returns, it’s not just about chasing high yields—it’s about understanding how ETFs, exchange-traded funds that track assets like stocks or bonds, crypto, digital currencies used for investment and payments, and fintech moats, the lasting advantages big financial tech companies build with data and regulation actually work together to protect and grow your money.

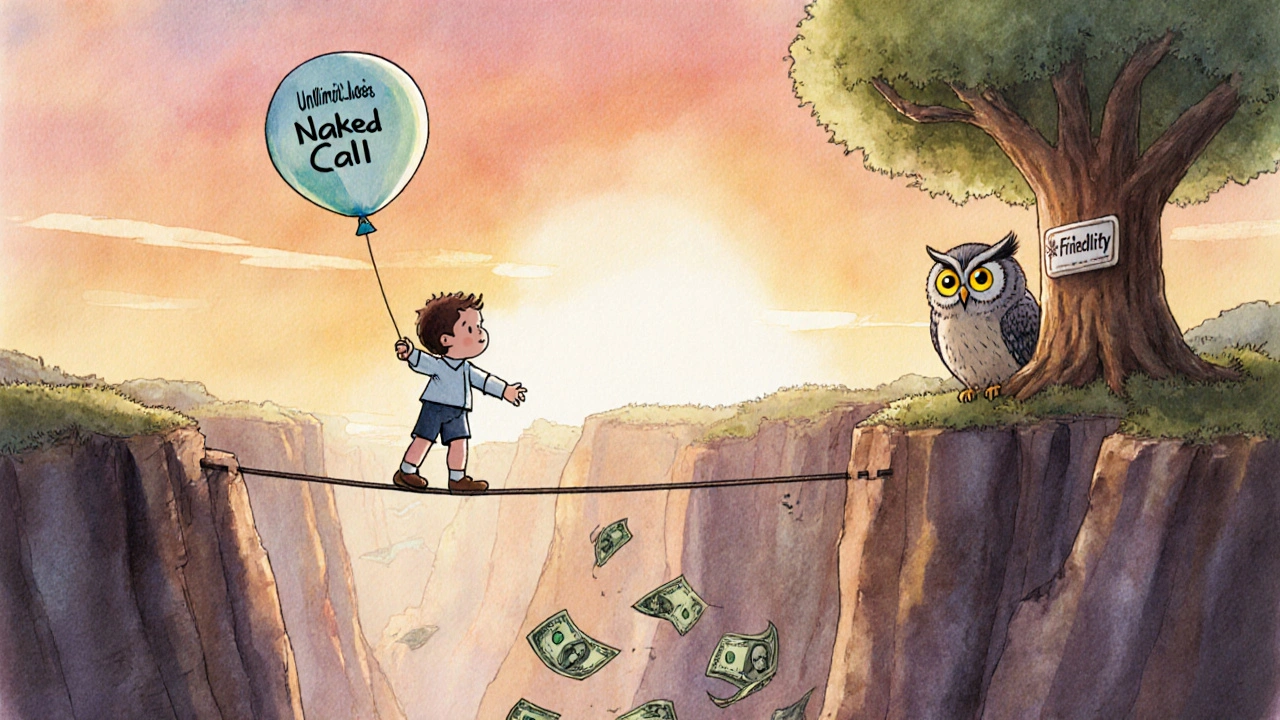

Most people miss the real difference between a good return and a smart one. It’s not about picking the hottest coin or the lowest fee broker—it’s knowing when to use a trust instead of a Transfer on Death deed, why mortgage REITs can crush your portfolio if you ignore spread risk, or how mobile malware is stealing login info from banking apps right now. These aren’t theoretical ideas. They’re the exact topics covered in the posts below—each one built from real data, real tools, and real mistakes people make.

Below, you’ll find clear, no-fluff guides on what actually moves the needle: how to compare ETFs by holdings, not just fees; how small farmers in developing countries are using fintech to survive; and which brokers let you buy a fraction of Amazon for less than a coffee. No jargon. No hype. Just what works.