BNPL Cost Calculator

How BNPL Impacts Your Purchase

Calculate the real cost of Buy Now Pay Later options compared to standard payment methods. Based on real retail data from the article.

Your Payment Breakdown

Total Purchase:

Standard Payment:

BNPL Installments:

Total Cost:

Retailer Revenue:

Additional Revenue:

How This Works

Based on article data: BNPL increases average order value by 32%. Calculations show:

- 4-month interest-free BNPL plans

- Standard payments include 15-25% conversion rate boost from embedded payments

- BNPL may carry hidden costs for consumers

Imagine buying a new pair of shoes and getting a loan offer right on the checkout page - no app switch, no login, no paperwork. That’s not science fiction. It’s embedded finance - and it’s already reshaping how people interact with money. By 2025, more than half of all software platforms in North America are offering financial services directly inside their apps. This isn’t just a trend. It’s a fundamental shift in how finance works.

Embedded Payments: The Most Common Use Case

Embedded payments are the most widespread form of embedded finance. Instead of redirecting customers to PayPal or Stripe’s payment page, businesses now process payments directly on their own site or app. Shopify merchants using embedded checkout saw conversion rates jump by 15-25%. Why? Because friction kills sales. Every extra click, every new login, every pop-up ad for credit cards drops customers out of the buying flow.

Platforms like Shopify Balance and Stripe Treasury let businesses accept payments, hold funds, and even pay suppliers - all without leaving their dashboard. One Shopify store owner in Austin reported cutting banking fees by 45% and saving 12 hours a week on bookkeeping. That’s not a small win. For small businesses, time and cost savings like that mean the difference between growth and survival.

Technical performance matters too. Leading embedded payment systems process transactions in under 500 milliseconds with 99.99% uptime. That’s faster than loading a webpage. And they’re built to handle PCI-DSS compliance automatically, so merchants don’t need to hire a security expert just to take a credit card.

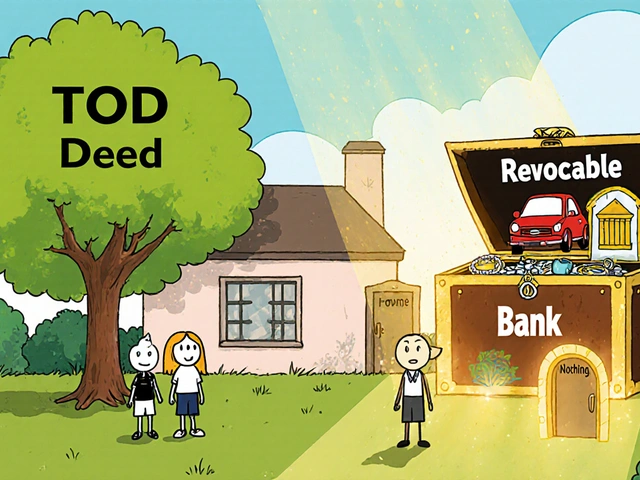

Buy Now, Pay Later (BNPL) Is Everywhere - But Not Always Simple

BNPL is the poster child of embedded lending. You’re looking at a $600 mattress on Wayfair. At checkout, you see: "Pay in 4 installments, interest-free." You click. Done. No credit check. No form. Just approval.

Klarna and Affirm power these options for thousands of retailers. Klarna’s BNPL increases average order value by 32% on average. For retailers, that’s pure revenue lift. But here’s the catch: approval rates for subprime customers are 30-40% higher than with traditional credit cards. That sounds good - until you realize these loans are often approved using non-traditional data like browsing behavior, device type, or past purchase patterns. No one explains that. No one warns you.

Reddit users are calling it out. One person wrote: "I didn’t realize I’d signed up for five BNPL loans across different apps. By the end of six months, I owed $3,200. No one told me I was borrowing money." The Federal Reserve found that BNPL users are more likely to fall behind on payments than credit card users - not because they’re irresponsible, but because they don’t see the debt accumulating.

And it’s not just consumers. Retailers using BNPL report higher return rates. People buy more, then return more. That’s a hidden cost.

Embedded Lending for Small Businesses

Small business owners don’t have time to apply for loans. They need cash fast. That’s where Shopify Capital and Square Capital come in. These platforms offer merchant cash advances directly inside their e-commerce dashboards. Approval? Under 24 hours. No tax returns. No bank statements. Just an algorithm that looks at your sales history.

Shopify Capital now offers advances up to $2 million. The repayment is simple: a fixed percentage of daily sales. If you sell $500 today, you pay back $50. If you sell $20, you pay back $2. It’s aligned with cash flow. That’s why 87% of retailers using embedded lending say they’re satisfied - compared to just 58% with traditional bank loans.

But there’s a dark side. These loans often come with high effective APRs - sometimes over 20%. And since they’re not labeled as "loans," many business owners don’t realize they’re borrowing. The FTC is now investigating whether these products should be regulated like traditional credit.

Embedded Insurance: Slow to Catch On

Insurance is the slowest-moving piece of embedded finance. Why? Because claims are messy. You can’t automate a car accident or a broken laptop the way you can approve a $50 payment.

But things are changing. Edenred partnered with Eyst Technology to use virtual cards for insurance payouts. When a customer files a claim on a travel app, the payout goes directly to their digital wallet - no check, no bank transfer, no waiting. Payouts now happen in 90% less time.

Still, adoption is low. Gartner’s 2025 report shows only 63% satisfaction among businesses using embedded insurance. The main complaint? Claim denials without clear explanations. One user wrote: "I got a $1,200 payout denied because my phone was "not in good condition." No photos were requested. No agent contacted me. Just a flat rejection."

Embedded insurance works best when it’s simple: extended warranties on electronics, trip cancellation on booking sites, or accidental damage on rental gear. Anything more complex still needs human review - and that breaks the embedded experience.

Embedded Banking: The Hidden Revolution

Most people think of banks as brick-and-mortar branches or apps with balance checks. But embedded banking is different. It’s when your SaaS platform becomes your bank.

Stripe Treasury lets businesses hold money in FDIC-insured accounts up to $1 million per account. They can send ACH payments, receive wire transfers, and even earn interest - all without opening a business bank account. QuickBooks and Xero now offer the same. For freelancers and solopreneurs, this means no more juggling between PayPal, Chase, and Wave. Everything lives in one place.

And it’s growing fast. In 2024, 42% of U.S. software platforms serving small businesses offered embedded banking features. That’s up from 30% just two years ago. The value? Lower fees, faster access to funds, and no need to maintain a separate banking relationship.

Embedded Wealth: The Next Frontier

Investing is the newest frontier. Robinhood embedded fractional shares into its social feed. Now, you can buy $5 of Apple stock after watching a video about tech trends. Cash App lets you buy Bitcoin with a tap while splitting dinner bills. Even Uber drivers can now invest a portion of their earnings automatically through a partnership with Acorns.

These aren’t full-service brokerages. They’re micro-investing hooks - small, simple, and tied to behavior. A user doesn’t need to understand asset allocation. They just need to see a button that says "Invest your spare change."

But this raises questions. Is it financial empowerment - or financial distraction? MIT’s FinTech Lab warns that embedding investing into entertainment apps blurs the line between spending and saving. People think they’re "saving," but they’re actually gambling with money they didn’t plan to invest.

Who’s Winning the Embedded Finance Race?

The market is split three ways:

- Platform companies (Shopify, Uber, DoorDash): They own the customer and use finance to lock them in.

- Fintechs (Stripe, Marqeta, Klarna): They build the infrastructure and power the backend.

- Traditional banks (Chase, Wells Fargo): They’re playing catch-up, often partnering with fintechs instead of building their own.

Shopify leads in commerce with 28% market share. Stripe controls 35% of payment infrastructure. Klarna owns BNPL. But the real winners? The small businesses and consumers who get faster, cheaper, simpler financial tools - without ever leaving the app they’re already using.

The Big Risks

Embedded finance isn’t risk-free.

Regulation is the biggest headache. In Europe, you need PSD2 compliance. In the U.S., you need to navigate 50 different state laws. 78% of companies say international expansion is blocked by compliance costs. One fintech executive told me: "We spent $1.2 million on legal fees just to launch in Canada."

Data privacy is another concern. Embedded finance means your shopping habits, income, and spending patterns are now tied to financial decisions. No one owns that data. No one is fully accountable.

And then there’s debt. When financial products are hidden inside games, shopping carts, and ride apps, people don’t realize they’re borrowing. The result? Hidden debt, surprise fees, and financial stress.

But here’s the truth: the benefits outweigh the risks - if done right. When embedded finance is transparent, fair, and easy to understand, it helps people manage money better. When it’s sneaky and opaque, it hurts them.

What’s Next in 2025-2026?

The next big wave is cross-border embedded payments. A freelancer in Mexico can now get paid in USD directly through a freelance platform - no Wise, no PayPal fees, no currency conversion lag. Volume is expected to grow 47% this year.

Real-time payments are also exploding. In the U.S., FedNow is enabling instant transfers between banks. Embedded platforms are integrating it. Soon, you’ll be able to send money to a vendor and have it arrive in seconds - not days.

And AI is starting to play a role. One startup is using machine learning to predict when a small business will need a cash advance - and offering it before they even ask. That’s not finance. That’s foresight.

By 2030, embedded finance could account for 35% of all financial services revenue. That’s $1.2 trillion. But if regulators don’t step in, that number could drop to 25%. The future isn’t just about technology. It’s about trust.

Embedded finance is basically capitalism’s way of making debt invisible-like putting sugar in your coffee until you’re diabetic and don’t even realize it’s there. The whole premise hinges on behavioral nudges disguised as convenience. You’re not buying shoes-you’re signing a promissory note wrapped in a Shopify button. And the worst part? The algorithm doesn’t care if you can pay. It only cares if you clicked ‘Buy Now.’

We’ve turned financial literacy into a UX problem. If the interface is smooth, we assume the product is ethical. But transparency isn’t a toggle in Figma. It’s a cultural contract. And right now, we’re breaking it-quietly, efficiently, and with 99.99% uptime.

BNPL isn’t ‘interest-free.’ It’s interest-obscured. The real cost isn’t in APR-it’s in cognitive load. People don’t track five micro-loans because they’re not labeled as loans. They’re labeled as ‘checkout options.’ That’s not innovation. That’s linguistic gaslighting.

And don’t get me started on embedded wealth. Investing $5 of spare change after watching a TikTok about Tesla? That’s not financial empowerment. That’s gamified gambling with FDIC insurance as a placebo. MIT’s right: we’re blurring lines until there are no lines left. Just a glowing button and a vague sense of accomplishment.

The real winners? The platforms. They own the data, the flow, the feedback loop. The consumer? Just a revenue stream with a username.

Ugh. Another ‘embedded finance is the future’ thinkpiece. Newsflash: it’s not the future-it’s the *present* and it’s already gross. You think Shopify Capital is helping small businesses? Nah. It’s predatory leasing with a dashboard. 20% APR? Called it a ‘cash advance’ so you don’t scream. And don’t even get me started on Klarna’s ‘no credit check’-they’re just using your Instagram likes and typing speed to judge your creditworthiness.

Embedded insurance? ‘Denied because your phone wasn’t in good condition.’ No photos? No agent? Bro, that’s not fintech, that’s a bot on a caffeine bender.

And don’t act like this is democratizing finance. It’s just making debt sexy. You’re not ‘investing spare change’-you’re letting Robinhood turn your dopamine hits into collateral. This isn’t innovation. It’s financial seduction. And we’re all just drunk on the UX.

I appreciate how this post breaks down the mechanics, but I keep thinking about the quiet people who don’t even realize they’re borrowing. My cousin, a single mom working retail, used BNPL on three different apps for back-to-school stuff. She thought it was like layaway. By December, she was juggling four payments she didn’t understand. No one told her it was debt. No one showed her the fine print.

Embedded finance isn’t inherently bad-it’s just poorly designed for empathy. The real win would be if these platforms added a simple, one-sentence explanation: ‘This is a loan. You’ll pay back $X over Y weeks.’

It’s not about stopping innovation. It’s about asking: who is this really helping? And who’s being quietly exploited because the interface is too smooth?

Also, the embedded banking stuff? That’s actually kind of brilliant for freelancers. No more waiting three days for a PayPal transfer. That part? I’m all for it.

Maybe the goal should be: make it seamless, but never silent.

Thank you for writing this. 🙏

From India, I see how this is spreading fast here too-especially in e-commerce apps. But many people don’t understand what they’re agreeing to. I hope regulators act soon.

Simple clarity > fancy UX.

Peace.