Naked Options Margin Calculator

Naked Options Risk Calculator

Margin Requirements

Minimum Account Balance Required:

Margin Maintenance Level:

Risk Assessment

Potential Loss if Assigned:

Note: Naked calls have unlimited loss potential. This calculator shows worst-case scenario.

Trading naked options isn’t just risky-it’s one of the most dangerous moves you can make in options trading. You sell a call or put without owning the underlying stock or holding any hedge. If the market moves against you, your losses can be naked options unlimited. That’s why every major broker-Fidelity, TD Ameritrade, Charles Schwab-locks this strategy behind a high-level approval system. You can’t just click a button and start selling naked calls. You need to prove you understand the stakes.

What Exactly Are Naked Options?

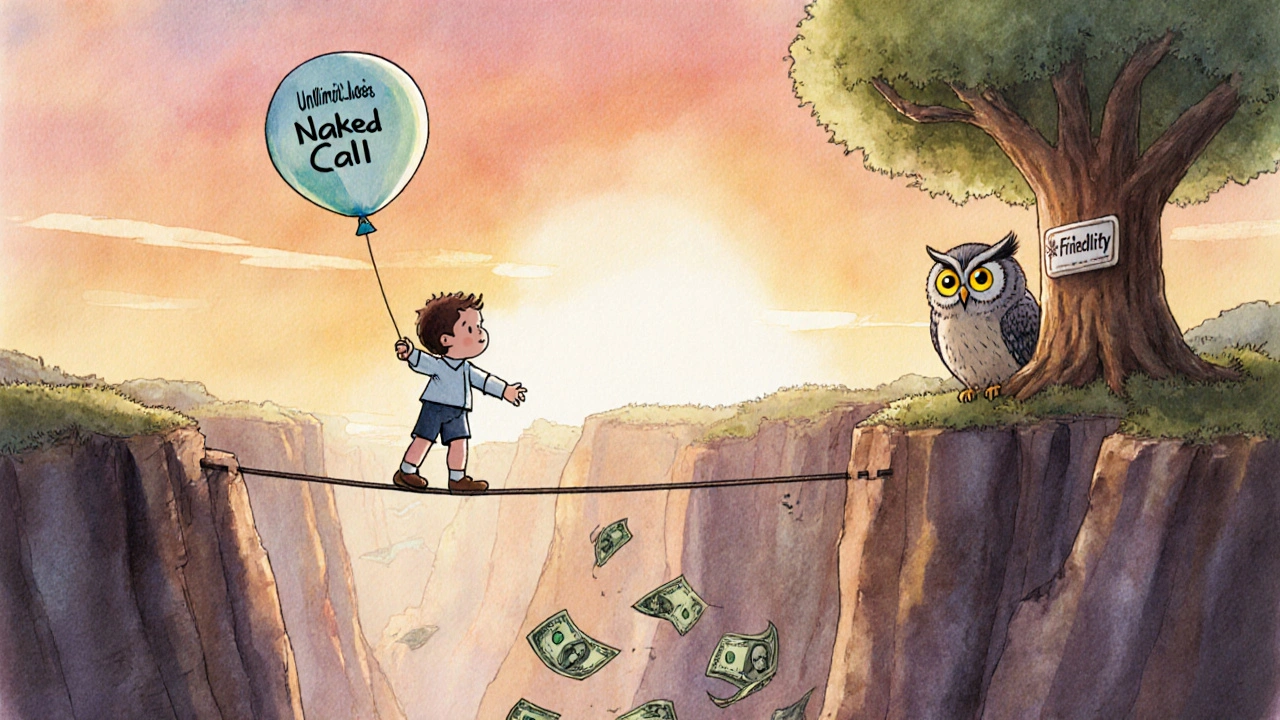

A naked call means you sell the right for someone to buy a stock at a set price, but you don’t own the stock. If the stock skyrockets, you have to buy it on the open market at whatever price it’s trading to fulfill the contract. There’s no cap on how high the price can go. That means your loss could be $50,000, $200,000, or more-even if you only collected $500 in premium. A naked put is slightly less terrifying, but still dangerous. You sell the right for someone to sell you a stock at a set price. If the stock crashes to zero, your maximum loss is the strike price times 100 shares (per contract). So if you sold a $20 put on a stock that goes to $0, you owe $2,000. That’s a lot for a $200 premium. Both strategies rely on the option expiring worthless. You’re betting the stock won’t move much. But markets don’t care about your bet. Earnings reports, Fed announcements, or a viral Reddit thread can send a stock 50% higher in a day. That’s when naked options turn into financial disasters.Why Brokers Won’t Let You Trade Them Without Approval

Brokers aren’t being difficult. They’re following rules from FINRA and the SEC. These regulators require firms to make sure you can handle the risk before letting you trade naked options. It’s not about protecting the broker-it’s about protecting you from yourself. The approval process isn’t a formality. It’s a filter. To get Level 5 options approval (the highest tier), you need:- A minimum account balance of $50,000 to $100,000 (up from $25,000 after 2021)

- At least 12 to 24 months of documented options trading experience

- Pass a written exam on options risk, margin rules, and loss scenarios

- Sign multiple disclosures acknowledging unlimited loss potential

The Hidden Cost: Margin Requirements

Naked options aren’t just risky-they’re capital-hungry. Brokers don’t let you trade them on regular margin. They demand much more. For a naked put, you typically need to set aside 20% of the stock’s value plus the premium you collected. But during volatility spikes, that can jump to 30% or more. For naked calls, the margin requirement is theoretically unlimited. Brokers use complex formulas based on potential price swings, and if your account equity dips below the required level, they’ll close your position-no warning, no mercy. In January 2021, during the GameStop rally, brokers forced liquidations on thousands of naked call sellers. One trader in Ohio lost $187,000 on a single position. He’d collected $2,300 in premium. The broker didn’t care about his “plan.” They just closed the trade to protect themselves from default.

Why Even Experienced Traders Avoid Naked Options

You might think, “I’ve traded for years. I can handle this.” But experience doesn’t eliminate risk-it just makes you better at recognizing when to walk away. Most professional traders who use options stick to spreads, straddles, or iron condors. These strategies cap losses. They’re complex, but they’re designed to survive volatility. Naked options have one job: collect premium. That’s it. No safety net. No downside protection. And in today’s market, with AI-driven trading, meme stocks, and algorithmic volatility spikes, the odds of an option expiring worthless are lower than ever. A 2023 study by the Options Clearing Corporation showed that during high-volatility periods, naked call options expired in-the-money 37% of the time-up from 19% in 2018. That’s a near doubling of failure rate. And when they fail, they fail hard.What Happens If You Ignore the Rules?

Some traders try to sneak around broker restrictions. They open accounts with smaller brokers that have looser rules. Or they use cash-secured puts as a cover, pretending they’re not taking naked risk. That doesn’t work. Brokers monitor positions in real time. If you sell a call without owning the stock, they flag it. If you’re under-margined, they liquidate. If you repeatedly violate rules, they freeze your account. And it’s not just about money. The SEC has issued multiple risk alerts since 2022 targeting brokers who approve inexperienced traders for naked options. Firms that cut corners are getting fined. That means the approval process is getting tighter, not looser.

Is There Any Scenario Where Naked Options Make Sense?

Technically, yes. But only for a tiny group. If you have $200,000+ in a margin account, have traded options for 3+ years, understand volatility surfaces, and can afford to lose $10,000 on a single trade without affecting your lifestyle-you might consider it. Even then, most pros limit naked options to 2-5% of their total portfolio. They also exit early. If a naked call moves 150% against them, they close it. No hoping. No doubling down. They treat it like a fire drill: contain the damage, then walk away. For everyone else? It’s gambling dressed up as trading.What Should You Trade Instead?

If you’re drawn to naked options because you want to collect premium, there are safer ways:- Cash-secured puts: You set aside the cash to buy the stock if assigned. Max loss is known. Margin is lower.

- Covered calls: You own the stock. Sell calls against it. Your risk is capped to the stock’s downside.

- Iron condors: Sell both a put spread and a call spread. Profit if the stock stays in a range. Max loss is defined.

Final Reality Check

Naked options aren’t a shortcut to wealth. They’re a trap for the overconfident. Brokers require Level 5 approval not to be gatekeepers-they’re trying to stop you from blowing up your account. The market doesn’t reward bravery. It rewards discipline. And discipline means knowing when not to trade. If you’re asking how to get approved for naked options, you’re probably not ready. And that’s okay. The best traders aren’t the ones taking the biggest risks. They’re the ones who walk away when the risk doesn’t make sense.Are naked options illegal?

No, naked options are not illegal. They’re legal in the U.S. under SEC and FINRA rules. But brokers are required to restrict access to traders who meet strict experience and capital requirements. You can’t trade them unless you’re approved at the highest level (Level 5).

How much money do I need to trade naked options?

Most brokers require a minimum of $50,000 to $100,000 in your account to qualify for Level 5 options approval. Some, like Interactive Brokers, may require even more depending on your trading history. It’s not just about the balance-you also need documented experience and must pass a risk assessment exam.

Can I lose more than I invest in naked options?

Yes, absolutely. With naked calls, your losses are theoretically unlimited because stock prices can rise forever. Even with naked puts, you can lose up to the full strike price times 100 shares per contract. Brokers require margin to cover these risks, but if your account falls below maintenance levels, they’ll close your position-possibly at a massive loss.

Why do brokers make the approval process so hard?

Brokers are legally required to ensure you understand the risks before allowing high-risk trades. After the 2021 meme stock surge and multiple retail investor losses, regulators cracked down. Brokers now face fines if they approve inexperienced traders for naked options. The process is hard because the consequences of getting it wrong are catastrophic-for you and the broker.

What’s the success rate for naked options traders?

There’s no official statistic, but industry data suggests fewer than 1 in 5 traders who attempt naked options consistently profit over time. The probability of an option expiring worthless has dropped since 2018 due to increased market volatility. Most successful traders who use naked options treat them as a small, controlled part of a larger strategy-not as a primary income source.

Brokers locking this behind Level 5? Honestly? Good. 😅 I saw a guy on r/WallStreetBets lose his entire 401(k) on a naked call on AMC last year. He thought he was "playing the system." Turned out he was just playing the fool. I’m not even trading options yet-just watching. And I’m glad there’s a wall between me and that kind of chaos.

I appreciate how this post breaks down not just the mechanics, but the psychology behind why brokers enforce these rules. It’s not about gatekeeping-it’s about preventing people from making irreversible mistakes out of overconfidence. I’ve seen friends chase quick premiums without understanding margin calls, and it’s ugly. The fact that the OCC data shows naked calls expiring ITM nearly doubled since 2018? That’s not a fluke. It’s a warning sign written in numbers.

Y’all need to stop acting like naked options are some secret cheat code. Nah. They’re the financial equivalent of skydiving without a parachute and calling it "freedom." 🚨 I’ve got a buddy who used to trade them like he was in a casino-he’d say "I got a plan!" But his plan was just hoping the market would be nice to him. Spoiler: it wasn’t. Now he’s back to iron condors and actually sleeping at night. Brokers aren’t the enemy-they’re the ones trying to keep you from becoming a cautionary tale in a Zoom meeting.

Let’s be brutally honest: if you’re asking how to get approved for naked options, you’re already too close to the edge. The system isn’t broken-it’s working exactly as designed. That Ohio trader who lost $187k? He wasn’t some unlucky victim-he was a statistical inevitability. Brokers don’t liquidate because they’re evil. They do it because if they don’t, the whole system collapses. FINRA isn’t babysitting you-they’re preventing systemic risk from leaking into retail accounts. And if you think you’re smarter than the algorithm, the market, and 10 years of regulatory hindsight? You’re not a trader. You’re a liability.