Investor Risk Exposure Calculator

Risk Exposure Assessment

Enter your current portfolio details to see if you're within safe trading limits

Recommendation:

Enter your portfolio details to see risk assessment

Every year, over $2.1 trillion vanishes from retail investors’ accounts-not because the market crashed, but because they made the same mistakes over and over again. In 2025, with apps that let you trade in seconds, TikTok gurus pushing meme stocks, and algorithms dominating 70% of market volume, new investors are more exposed than ever. The good news? You don’t need to be a genius to avoid these traps. You just need to know what they are-and how to stop them before they cost you.

Trading Too Much

You open your app. The market moved 1%. You feel something. You click buy. Then sell. Then buy again. By the end of the week, you’ve made 15 trades. Sounds familiar? That’s overtrading, and it’s the #1 killer of new investors.Vanguard found that traders who make more than 10 trades a month underperform the market by 1.5% every year. Why? Because every trade costs money-commissions, spreads, taxes-and most of the time, you’re just reacting to noise. In 2025, the average holding period for a stock is 5.3 days. That’s not investing. That’s gambling with a spreadsheet.

Here’s how to fix it: Set a rule. Only one trade per week. No exceptions. If you’re tempted to trade more, write down why. Then wait 24 hours. Most of the time, the urge disappears. Use your broker’s calendar feature to block trading days. Or better yet, set up automatic investments. Put $200 in on the 1st and 15th of every month. Let the market do its thing.

Sticking to Losing Trades

You bought Tesla at $250. It’s now $180. You tell yourself, “It’ll bounce back.” You hold. And hold. And hold. Six months later, it’s $140. You’ve lost 44%.This isn’t patience. This is pride. Behavioral research from the University of Chicago shows that new investors hold losing positions 3.2 times longer than winning ones. Why? Because admitting a mistake feels like failure. But in investing, not cutting losses is the real failure.

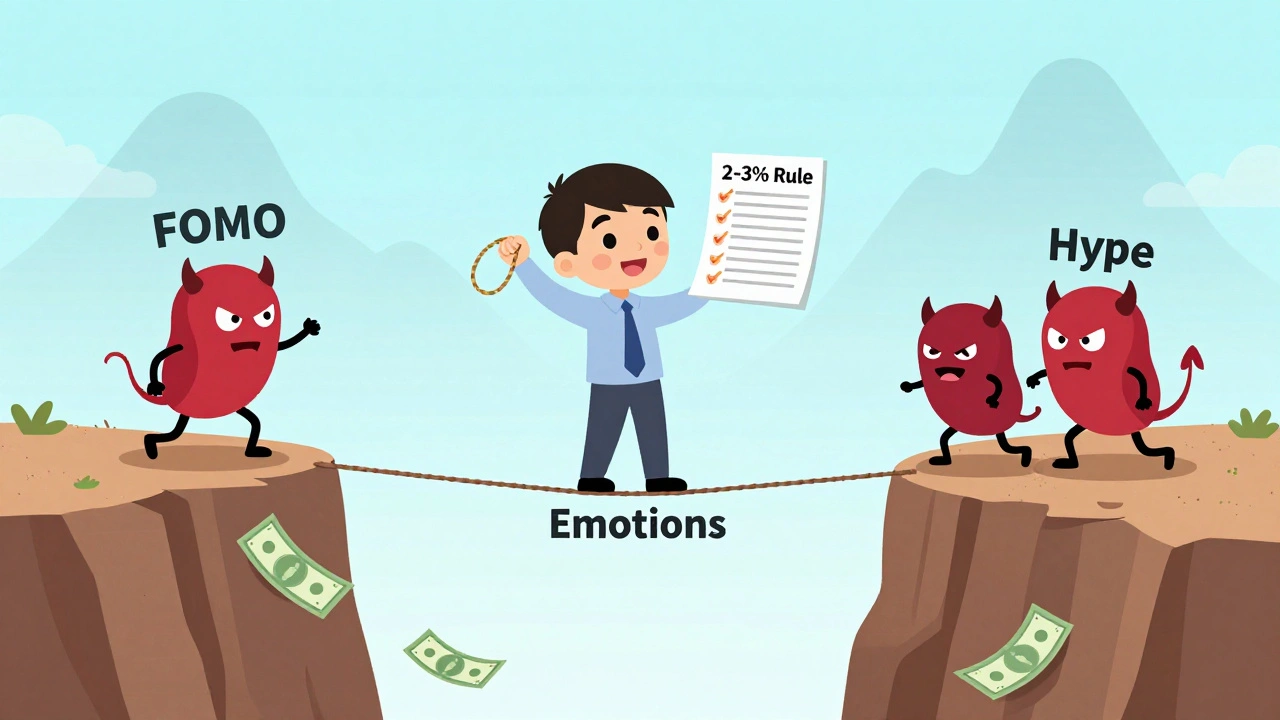

Fix this with a simple rule: Never risk more than 2-3% of your total account on any single trade. If you have $10,000, that’s $200-$300 max per trade. Set a stop-loss at the same time you buy. If the price hits that level, you’re out. No second-guessing. No hoping. No emotional drama. Just execution.

And here’s the kicker: You don’t need to be right every time. You just need to lose small and win big. One winning trade can make up for five small losses. But if you let one loss grow to 30%, 40%, 50%, you’re playing a game you can’t win.

Following Social Media Tips

You see a video: “This AI stock will 10x by June!” You check the chart. It’s going up. You jump in. Two weeks later, it’s down 40%. The influencer moved on to the next “sure thing.”A joint MIT and NYU study in March 2025 found that investors who follow TikTok or X (Twitter) tips underperform the market by 14.3% annually. Why? Because those posts aren’t advice-they’re marketing. The person posting either owns the stock and wants to dump it, or they’re selling a course. Either way, you’re the product.

Real investors don’t chase hype. They look at fundamentals. What’s the company’s revenue growth? Does it have a real competitive edge? Is it profitable? If you can’t answer those in 30 seconds, don’t buy it. Period.

Here’s a better habit: Unfollow every “guru” on social media. Mute hashtags like #StockPicks and #DayTrading. Instead, read one annual report per quarter. Start with companies you use every day-Nike, Apple, Costco. You’ll learn more from their 10-K filings than from 100 TikTok videos.

Using Leverage Like It’s Free Money

You see a platform offering 5x leverage on crypto. “I can make 50% in a week!” you think. You put in $1,000. It goes up 10%. You feel like a genius. Then it drops 12%. Your $1,000 is gone. You owe $500.Leaving leverage out of your portfolio isn’t conservative-it’s survival. Morgan Stanley’s data shows that 62% of leveraged retail positions result in total capital loss within 18 months. That’s not risk. That’s suicide.

Even 2x leverage is dangerous for new investors. Markets don’t move in straight lines. They swing. They gap. They crash. A 10% drop in a 2x leveraged position wipes out 20% of your equity. One bad day, and you’re out.

Stick to cash. No margin. No options. No futures. Just plain stocks. Build your account slowly. Learn how markets behave without artificial pressure. When you’re ready for advanced tools, you’ll know it. Until then, leverage is a trap disguised as a shortcut.

Trying to Time the Market

You wait for the “right time” to invest. You watch the news. You check the VIX index. You read analyst forecasts. You do nothing for months.Meanwhile, the market keeps rising. You miss the 10 best days in a decade. Fidelity’s 90-year analysis shows that missing just those 10 days cuts your returns by 4.2% annually. That’s not a small gap. That’s $20,000 lost on a $100,000 portfolio over 10 years.

There is no “right time.” No one can predict the next crash-or the next rally. Even the best hedge funds get it wrong half the time. Trying to time the market is like trying to catch a falling knife. You might get lucky once. But eventually, you’ll cut yourself.

Do this instead: Dollar-cost average. Put the same amount in every month, no matter what. $100. $500. $1,000. Doesn’t matter. Buy when it’s high. Buy when it’s low. Let the math even it out. Over 10 years, this strategy beat the S&P 500 by 0.5% annually, according to Vanguard. And it takes zero guesswork.

Ignoring Risk Management

You have a $15,000 portfolio. You put $8,000 into one stock because “it’s a sure thing.” You don’t have a stop-loss. You don’t rebalance. You don’t track your risk per trade.This is not investing. This is Russian roulette with a spreadsheet.

Charles Schwab’s 2024 report found that 68% of new investors risk 5% or more per trade-double the safe limit. That means one bad trade can wipe out a third of your account. One more, and you’re done.

Here’s your risk management checklist for 2025:

- Never risk more than 2-3% of your total account on any single trade.

- Set a stop-loss on every position before you buy.

- Rebalance your portfolio every quarter. If one stock grew too big, sell a little and buy others.

- Keep at least 10% in cash. Not to time the market-to sleep at night.

Rebalancing takes 15 minutes a quarter. But it improves returns by 1.8% a year and cuts volatility by 22%. That’s free money. And it’s not hard.

Believing You Can Predict the Future

You look at a stock that went up 30% in six months. You think, “It’s going up another 50% next quarter.” You’re wrong. Holborn Asset Management’s data shows that stocks rising 30% in six months underperform the market 68% of the time over the next year.This is called recency bias. Your brain remembers the last thing that happened and assumes it’ll keep going. But markets don’t work that way. They mean-revert. They correct. They reset.

Phil Town’s “Four M’s” method-Meaning, Moat, Margin of Safety, Management-is the antidote. Ask:

- Does this company solve a real problem? (Meaning)

- Does it have a lasting advantage? (Moat)

- Is it priced below its true value? (Margin of Safety)

- Is the leadership trustworthy? (Management)

If you can’t answer all four, skip it. Don’t chase momentum. Chase value. And don’t trust your gut. Trust data.

Checking Your Portfolio Too Often

You open your app 12 times a day. You refresh every hour. You panic when the market dips 1%. You feel anxious. You sell.Fidelity’s survey found that 57% of retail investors check their portfolios more than 10 times daily. And 39% make impulsive trades during those checks. Your brain isn’t wired for investing. It’s wired for survival. A 1% drop feels like a threat. But in reality, it’s just noise.

Here’s what works: Set one daily check-in. Morning or evening. Just one. Use a desktop app, not your phone. Turn off notifications. Block the app for 12 hours if you have to. The less you look, the more you earn.

Studies show that investors who check less often have 27% higher long-term returns. Why? Because they don’t react to fear. They stick to the plan.

Not Using a Demo Account

You open a brokerage account. Deposit $500. Start trading. No plan. No rules. No practice.That’s like getting behind the wheel of a car for the first time and driving on the highway at 80 mph.

IG’s research says traders who spend at least 40 hours in a demo account before going live are 27% more profitable in their first year. Why? Because they learn the system. They test strategies. They make mistakes-without losing money.

Use your broker’s free demo account. Trade with fake money. Try different strategies. Test your emotions. See how you react when a stock drops 10%. Do you panic? Do you double down? Do you freeze?

Once you can stay calm and stick to your rules for 40 hours, you’re ready. Until then, you’re just gambling.

Not Having a Written Plan

You don’t have a plan. You just trade when you feel like it. That’s not investing. That’s chaos.Morgan Stanley found that investors who write a simple investment policy statement reduce emotional trading by 41%. All it takes is 3-5 hours. Here’s what to include:

- My goal: “Grow $10,000 to $50,000 in 10 years.”

- My strategy: “Dollar-cost average into index funds. Rebalance quarterly.”

- My risk limit: “No more than 2% per trade. No leverage.”

- My exit rules: “Sell if the company’s fundamentals break. Not because the price drops.”

Print it. Tape it to your wall. Review it every month. When you feel the urge to deviate, read it first. Then decide.

This isn’t boring. It’s powerful. It turns emotion into discipline. And discipline is the only edge you need.

What Happens If You Do Nothing?

The data doesn’t lie. In 2025, 89% of day traders lose money over 12 months. 92% of retail options trades expire worthless. 78% of meme-stock buyers enter at 40%+ premiums to real value. And 68% of new investors risk more than 5% per trade.If you do nothing, you’re part of that 89%. You’ll lose money. You’ll get frustrated. You’ll blame the market. You’ll quit.

But if you do these 8 things, you’re not just avoiding loss-you’re building wealth:

- Trade less

- Cut losses fast

- Ignore social media hype

- Avoid leverage

- Stop trying to time the market

- Stick to 2-3% risk per trade

- Check your portfolio once a day

- Write and follow a plan

These aren’t tips. They’re survival rules. And they work.

Start today. Not tomorrow. Not next week. Today. Open your demo account. Write your plan. Set your stop-loss. And don’t look back.

What’s the biggest mistake new investors make online?

The biggest mistake is overtrading. New investors think they need to act constantly, but the market moves slowly for long-term gains. Trading more than 10 times a month reduces returns by 1.5% annually, according to Vanguard. The solution? Set a limit-like one trade per week-and stick to it.

Should I use leverage as a beginner?

No. Leverage turns small losses into total wipeouts. Morgan Stanley found that 62% of leveraged retail positions result in complete capital loss within 18 months. Beginners should only trade with cash. No margin. No options. No futures. Build your account first, then learn advanced tools later-if ever.

Is it safe to follow stock tips on TikTok or X?

No. A joint MIT and NYU Stern study in March 2025 found that investors following social media tips underperformed the market by 14.3% annually. These tips are often paid promotions or pump-and-dump schemes. The SEC shut down 17 such influencers in 2025 for causing $412 million in losses. Always research a company yourself before buying.

How much should I risk on a single trade?

Never risk more than 2-3% of your total account on one trade. For a $10,000 portfolio, that’s $200-$300 max. This protects you from one bad trade wiping out your account. Charles Schwab’s 2024 report showed 68% of new investors risk 5% or more-putting them at high risk of failure.

Do I need to check my portfolio every day?

No. Checking more than once a day increases impulsive trading by 39%, according to Fidelity. Most people who check constantly sell low out of fear. Set one daily check-in time. Use a desktop app. Turn off notifications. You’ll trade less, sleep better, and earn more.

What’s the best way to start investing with little money?

Start with dollar-cost averaging. Invest $50-$100 every month into a low-cost index fund like VOO or VTI. Don’t try to pick stocks. Don’t time the market. Just keep adding. Over 10 years, this strategy returns 8.2% annually on average, according to Fidelity’s projections. It’s simple, slow, and powerful.

How long should I practice in a demo account before going live?

At least 40 hours. IG’s research shows traders who complete 40+ hours of demo trading are 27% more profitable in their first year. Use this time to test your emotions. Do you panic when a trade goes down? Do you chase losses? Practice until you can stick to your rules without emotion.

Can I still make money if I’m not a day trader?

Yes-by far. Long-term investors using dollar-cost averaging returned 9.2% annually from 2015-2024, outperforming the S&P 500. Day traders have an 89% failure rate. You don’t need to trade daily. You just need to be consistent, patient, and disciplined. That’s how real wealth is built.

Oh wow, another ‘investing guide’ that treats newbies like toddlers who can’t handle real life. Let me guess-Vanguard and Schwab wrote this? Newsflash: the system is rigged. Your ‘one trade a week’ rule? Cute. The algos are front-running your pathetic $200 buys while you’re waiting for your coffee to cool. If you’re not using leverage, you’re not playing the game-you’re just handing your money to hedge funds who bought your ‘safe’ index funds before you even opened an account. You think discipline wins? Nah. It’s just the placebo for people too scared to admit they’re being played.

And don’t get me started on ‘demo accounts.’ You think pretending to trade with fake money prepares you for real markets? That’s like practicing CPR on a mannequin while your actual neighbor is choking on a burger. Wake up. The game’s not fair. Stop pretending it is.

Also, ‘ignore TikTok gurus’? Bro, the gurus are just the tip of the iceberg. The real predators are the ones writing the ‘educational’ blogs you’re blindly trusting. Same playbook. Different suit.

Real investors don’t follow rules-they exploit loopholes. And if you’re not doing that, you’re not investing. You’re just donating to Wall Street’s retirement fund.

Y’all are still talking about ‘risk management’ like it’s some holy grail? Look, I’ve been trading since 2018. I lost my first $15k in six months. Then I stopped reading blogs and started reading SEC filings. No one told me to do that. I just got tired of being the sucker.

Here’s the truth: 90% of these ‘rules’ are just lazy people trying to feel in control. I don’t set stop-losses. I don’t rebalance quarterly. I don’t even check my portfolio on weekends. I buy companies I understand and hold until they stop making sense. That’s it.

And yeah, I used to follow TikTok picks. I lost money. Then I stopped. Not because some article told me to-because I’m not an idiot. You don’t need a 10-step plan to not get scammed. You just need to stop being desperate for a quick win.

Also, ‘dollar-cost averaging’? Sure. But if you’re putting $50 into VOO every month and calling that ‘investing,’ you’re not building wealth. You’re just paying your broker to babysit your money. Real wealth? It’s built by owning businesses-not ETFs.

I just want to say-this post hit me right in the feels. I used to be the guy checking my portfolio 12 times a day, panicking every time a stock dipped, and chasing every ‘10x’ meme stock I saw on Reddit. I lost so much money I couldn’t sleep.

Then I started journaling my trades. Not to track profits, but to track my emotions. Why did I buy? Was I excited? Scared? FOMO? I realized I wasn’t investing-I was self-medicating with adrenaline.

I started with $300. Put it in VTI. Set up auto-invest. Turned off notifications. Took a 3-month break from financial content. And guess what? I didn’t get rich. But I stopped losing. And that was the first real win.

If you’re reading this and feeling overwhelmed? You’re not behind. You’re just human. The market doesn’t reward speed. It rewards patience. And yes, you can do this. One small, calm step at a time. You’ve got this.

And if you need someone to talk to about it? I’m here. No judgment. Just real talk.

- John, who used to be you.

The structural fallacy in this entire piece is the conflation of ‘behavioral discipline’ with ‘market efficacy.’ One cannot assume that adherence to arbitrary rules-such as ‘one trade per week’ or ‘2% risk per position’-produces alpha. These are heuristics designed to mitigate cognitive bias, not generate returns.

Moreover, the citation of Vanguard and Schwab as authoritative sources is a red herring; these institutions profit from passive investing, and thus have a vested interest in promoting the myth of ‘buy-and-hold’ as universally optimal. The data is cherry-picked: the 8.2% annual return from dollar-cost averaging is predicated on a 10-year bull market, which may not be replicable in a stagflationary 2025.

Furthermore, the dismissal of leverage as inherently suicidal ignores the role of hedging and capital efficiency in portfolio construction. A 2x leveraged position, when paired with a volatility-targeting framework, can reduce drawdowns relative to unlevered equivalents under certain market regimes.

Finally, the recommendation to ‘read annual reports’ is not a panacea. Most 10-Ks are obfuscated by GAAP loopholes and management’s selective disclosure. Without forensic accounting training, you’re just reading propaganda with footnotes.

Discipline is necessary, but insufficient. You must also understand the architecture of the system you’re participating in-or you’re merely optimizing your own exploitation.

Let’s be real-this whole thing is just a glorified corporate ad for index funds. ‘Don’t trade too much’? Cool. But what if you’re not trying to be a passive investor? What if you’re trying to build something real? What if you want to outsmart the system instead of just feeding it?

Yeah, 89% of day traders lose. But 89% of everything fails. 89% of startups die. 89% of relationships crash. That doesn’t mean the other 11% aren’t worth it.

And don’t tell me ‘leverage is suicide.’ That’s what they said about crypto in 2017. People got wiped out. But the ones who survived? They didn’t follow rules-they studied patterns. They read the order flow. They watched the whales. They didn’t wait for a blog post to tell them when to buy.

Also, ‘ignore TikTok’? Bro, TikTok is the new Bloomberg Terminal. The real edge isn’t in reading 10-Ks-it’s in reading the sentiment. The crowd’s wrong 70% of the time, but the other 30%? That’s where the 10x moves happen. You don’t need to be right every time. Just right when it matters.

And yeah, I use leverage. I’ve lost money. I’ve made money. I’ve cried. I’ve celebrated. I’ve slept. I’ve stayed up all night. That’s the game. And if you’re not willing to feel the burn, you’re not playing-you’re just spectating.

So yeah. Follow the rules if you want to be safe. But don’t pretend it’s the only way. The real money’s made by the ones who break the rules… and survive.