Platform vs Product: What Really Drives Digital Financial Success

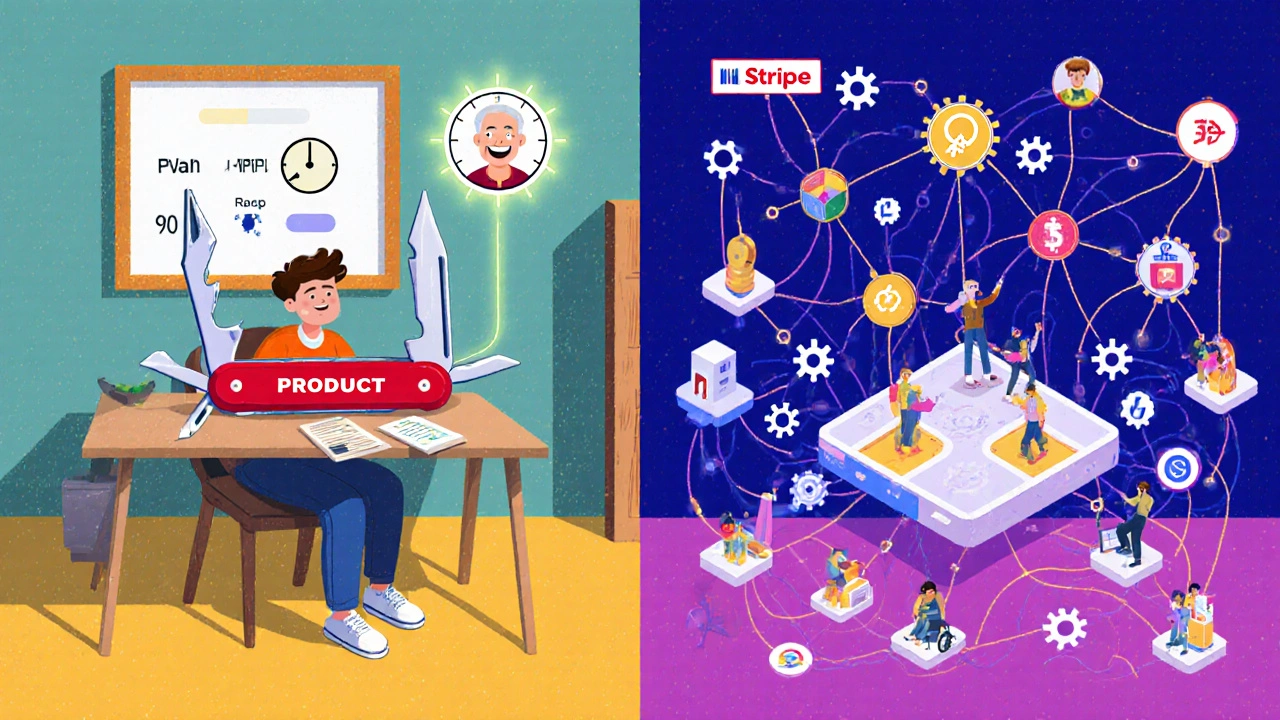

When we talk about platform vs product, a platform enables interactions between users and third parties, while a product delivers a standalone solution. Also known as ecosystem vs offering, this distinction shapes everything from how fintechs grow to why some apps succeed while others vanish. Most people think the best fintechs build better tools—like faster payments or prettier apps. But the real winners? They build platforms. Think Stripe, PayPal, or even Robinhood: they didn’t just sell a service. They created systems where others build on top of them. That’s why they scale faster, lock in users, and survive regulatory shifts that crush standalone products.

Take embedded finance, when financial services are woven directly into non-financial products like shopping or ride-hailing apps. Also known as financial integration, it’s not a product—it’s a platform feature. You don’t buy insurance from a bank. You buy it at checkout, right after you click ‘pay.’ That’s not a new product. That’s a platform enabling third-party insurers to plug in. The same goes for fintech moats, the structural advantages built from data, distribution, and regulation that keep competitors out. Also known as competitive moats, they’re not about having the best interest rate—they’re about owning the channel. Companies like Klarna or Affirm don’t just offer BNPL. They own the checkout flow. That’s a platform advantage. Meanwhile, standalone products—like a single bond fund or a basic robo-advisor—can be copied, undercut, or replaced in months.

The posts below show this pattern everywhere. You’ll see how platform vs product explains why RegTech cuts compliance costs by half—not because the software is smarter, but because it’s embedded into workflows. You’ll see how autoscaling isn’t just a tech trick—it’s a platform response to traffic spikes. You’ll find out why embedded insurance converts 50% of users while traditional policies struggle to hit 5%. And you’ll understand why the best financial advisors aren’t just giving advice—they’re running communication platforms that keep clients engaged. This isn’t theory. It’s what’s happening right now in every corner of digital finance. The winners aren’t the ones with the flashiest tools. They’re the ones who built systems others can’t easily leave.