Platform vs Product Decision Checker

Which model is right for your fintech company?

Answer these questions to determine whether your business should pursue a platform or product model.

Decision Criteria

When you’re building a fintech company, one of the first big decisions you’ll face isn’t about features, design, or even funding. It’s about platform versus product. This isn’t just a technical choice-it shapes your revenue, your team size, your regulatory burden, and whether you’ll survive past year three.

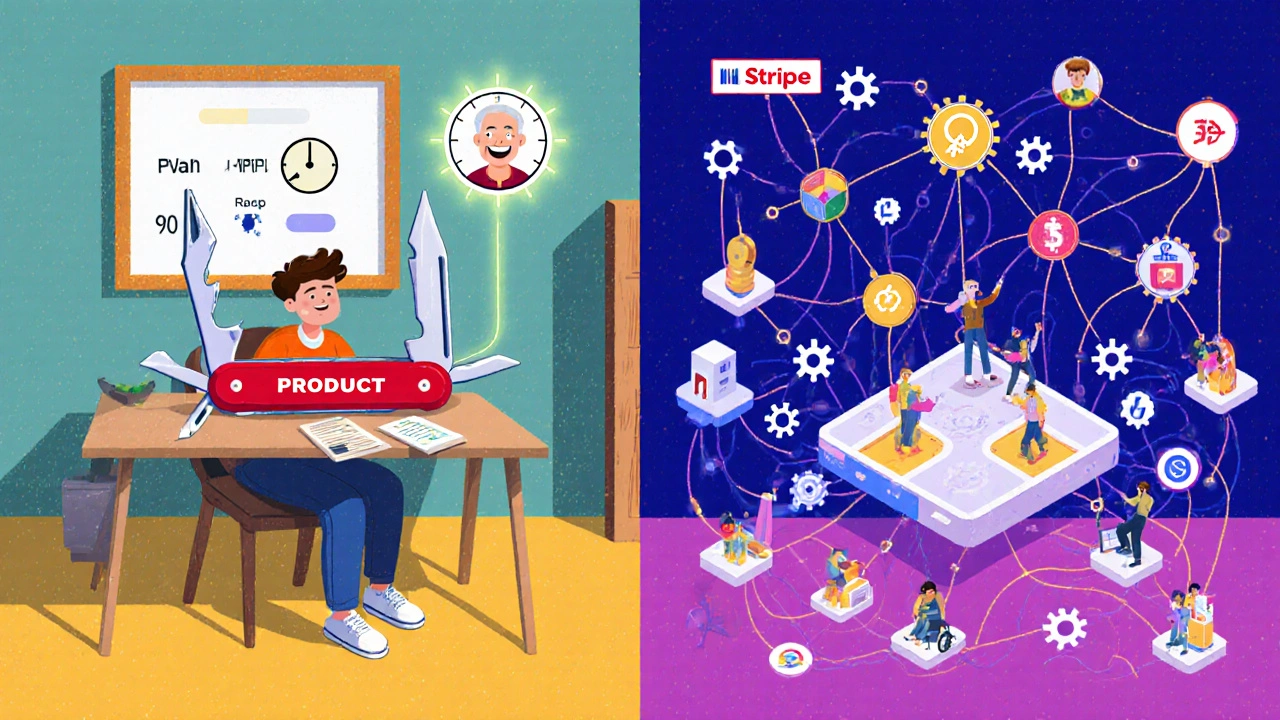

Let’s cut through the jargon. A product is a single, focused tool. Think of it like a Swiss Army knife with one sharp blade-perfect for a specific job. InvestEngine, for example, doesn’t try to be everything to everyone. It only offers ETF portfolios, carefully matched to a user’s age, risk tolerance, and investment horizon. There are exactly 10 portfolio options. No clutter. No confusing menus. Just clear, simple investing. That’s a product model: tightly controlled, easy to explain, and dead simple to use.

A platform, on the other hand, is an ecosystem. It doesn’t just serve users-it connects them. Stripe is the classic example. It doesn’t just process payments. It lets businesses connect their accounting software, tax tools, payroll systems, and fraud detectors-all through one API. The more companies use Stripe, the more developers build on top of it. The more developers build on it, the more valuable it becomes. That’s network effects. And that’s what makes platforms powerful.

Why Most Fintech Startups Begin as Products

Almost every fintech startup starts with a product. Why? Because it’s faster, cheaper, and easier to build.

A product MVP can be ready in 3 to 6 months with a team of 4 to 6 people. You focus on one user journey: sign up, verify identity, fund account, invest, get updates. That’s it. InvestEngine nailed this. Their risk questionnaire takes 90 seconds. Then users get one of ten portfolios. No guesswork. No upsells. Just clarity.

Product models also win on regulation. When you control everything-from the UI to the backend-you can design compliance into every step. KYC checks, transaction monitoring, data encryption-all built into one clean flow. That’s why niche fintechs targeting specific groups-like retirees, students, or gig workers-still thrive. They don’t need to be big. They just need to be perfect for one group.

But here’s the catch: products hit a wall. After year three, pure product fintechs grow 37% slower than platform companies, according to Amplitude’s 2023 analysis. Why? Because you’re constantly adding features just to stay relevant. You’re competing with every other app that offers “investing.” Without network effects, your growth depends entirely on paid ads and sales teams. And that gets expensive fast.

The Platform Trap: Why Most Fail Before They Take Off

Platforms look glamorous. They promise exponential growth. But here’s the dirty secret: 68% of fintech platforms fail within 18 months-not because of bad tech, but because they never got past the “cold start.”

What’s the cold start? It’s the chicken-and-egg problem. No merchants use your payment platform? Then no developers build tools for it. No developers? Then no merchants want to join. It’s a loop with no easy exit.

Platforms need two sides-and both sides need to show up at the same time. That’s why Stripe succeeded. They didn’t try to build a marketplace. They started by solving a real pain point for developers: “I need to accept credit cards without hiring a compliance team.” They made it so easy that developers wanted to use it. Then, businesses followed.

Building a platform isn’t just harder-it’s way more expensive. You need 8 to 12 months just to get an MVP out the door. Your team needs 10 to 15 people: engineers, compliance officers, API specialists, customer success reps for both end-users and partners. You need role-based access, multi-tenancy, audit logs, and 3 times the documentation.

And then there’s regulation. Platforms face 45% more regulatory scrutiny than products. Why? Because you’re not just handling your own users-you’re enabling third parties to move money, store data, and make financial decisions. One bad integration can bring down your entire compliance stack. The Financial Brand found that platform companies need 40% more documentation just to prove they’re not enabling fraud.

Who Wins? Enterprise vs. Retail

Not all customers are created equal. And your choice of model should depend on who you’re serving.

Product models dominate in retail. 78% of users on product-based fintech apps are individual consumers. They want simplicity. They don’t care about APIs. They want to know how much they’ll have in 5 years. That’s why apps like Acorns or Chime still grow-they’re clean, predictable, and easy to explain on TikTok.

But once a business hits $10 million in annual revenue, everything changes. Companies that size don’t want one app. They want one system that connects payroll, invoicing, accounting, taxes, and payments. That’s where platforms win. Django Stars’ 2023 survey found that 67% of companies with over $50 million in revenue use platform-based fintech tools. Why? Because they’re tired of juggling 12 different software licenses. They want one dashboard. One invoice. One compliance framework.

And here’s the kicker: platforms reduce customer acquisition costs by 22% through referrals. If a business uses your platform and loves it, they’ll tell their accountant, their bookkeeper, their ERP vendor. That’s organic growth. Products can’t do that. They rely on Google Ads and cold emails.

The Hybrid Future: Best of Both Worlds

The smartest fintech companies aren’t choosing between platform and product anymore. They’re blending them.

Fondy Flow is a great example. To the end user, it looks like a simple payment tool. You click, you pay, you’re done. But behind the scenes? It’s a full infrastructure platform. It handles virtual IBANs, multi-currency settlement, compliance checks, and reconciliation-all through a single API. Businesses get a product experience with platform power underneath.

This hybrid approach is the future. Amplitude predicts that by 2025, 80% of successful fintechs will use platform tech but hide it behind a product interface. Why? Because users still hate complexity. But companies still need scalability.

Think of it like a Tesla. The dashboard is simple-just a screen and a steering wheel. But under the hood? It’s a networked, over-the-air-updatable, AI-powered machine. That’s the goal: simple for the user, powerful for the business.

How to Decide: A Quick Checklist

Still unsure? Ask yourself these questions:

- Are you solving a single, specific problem? (e.g., “I want to invest in ETFs based on my age”) → Go product.

- Are you connecting multiple types of users? (e.g., merchants + developers + banks) → Go platform.

- Do you have the budget for a 10+ person team and 12+ months of development? → Platform.

- Are you targeting businesses with $10M+ revenue? → Platform.

- Are you competing in a crowded retail market with 50 similar apps? → Product-with a sharp differentiator.

- Can you build a network effect? (Will users bring others in?) → Platform.

If you answered “yes” to more than two platform questions, you’re probably better off building a platform-even if it scares you. If you answered “yes” to mostly product questions, don’t overcomplicate it. Build something beautiful, focused, and unforgettable.

What Happens After You Choose?

Choosing a model isn’t a one-time decision. It’s a signal to your team, your investors, and your customers.

Product teams focus on user retention, NPS scores, and feature polish. They measure how many people use the app every day. They optimize onboarding. They A/B test button colors.

Platform teams measure ecosystem health. How many developers are using your API? How many integrations are live? How many partners are adding value? They track connection growth, not just active users.

And here’s the truth: if you start as a product and later want to become a platform, you’ll need to rebuild. The architecture is different. The data model is different. The compliance requirements are different. There’s no easy upgrade path.

Same goes for the reverse. If you start as a platform and try to simplify into a product, you’ll lose the network effects that made you valuable. You’ll become just another app.

So choose wisely. Because your choice today will define your company’s trajectory for the next decade.

Can a fintech company switch from product to platform later?

Yes, but it’s extremely hard. Product models are built with tight, end-to-end control. Platforms require modular, API-driven architecture. Switching means rebuilding your core tech stack, compliance framework, and user permissions. Most companies that try end up launching a separate platform product instead of converting the original. It’s cheaper and safer.

Which model has lower regulatory risk?

Product models have lower regulatory risk. Since you control the entire user journey, you can design compliance into every step. Platforms face 45% more scrutiny because they enable third parties to interact with financial data. Each integration adds a new compliance surface. Regulators see platforms as higher-risk because one bad partner can compromise the whole system.

Why do platforms have higher latency in transactions?

Platforms add layers. Instead of going directly from user to bank, a transaction might pass through your API, then a partner’s system, then a compliance checker, then the bank. Each step adds milliseconds. Products cut straight to the point. That’s why a simple payment app can process a transaction in 200ms, while a platform might take 350ms. But platforms make up for it by handling millions of transactions across thousands of partners-something a product can’t scale to.

Is it better to target consumers or businesses?

It depends on your model. Consumers prefer products-they want simplicity, speed, and clarity. Businesses prefer platforms-they want integration, automation, and scalability. If you’re targeting consumers, build a product. If you’re targeting businesses with over $10M in revenue, build a platform. Trying to serve both at once usually leads to a confusing, bloated product that satisfies no one.

What’s the biggest mistake fintech founders make?

They copy what worked for Stripe or Plaid without asking: “Do I have the same network effects?” Most fintechs don’t. They build a platform because it sounds impressive, not because they have two sides of a marketplace ready to engage. The result? A $10 million engineering bill and zero users on one side. The best founders start small, prove value, then expand-not the other way around.

How do I know if my idea has network effects?

Ask: “Will my product get better when more people use it?” If the answer is yes, you might have a platform. For example: if a freelancer uses your invoicing tool, and their clients start using it too, that’s network effects. If your tool just helps one person manage their money, it’s a product. Network effects mean value grows with participation. If your app works the same whether 10 or 10,000 people use it, it’s a product.

Can I start with a product and add platform features later?

You can add integrations, but you can’t easily turn a product into a true platform. True platforms require multi-tenancy, role-based access, and API-first design from day one. If you build a product with a monolithic backend, adding a public API later will be messy, slow, and insecure. The better path: build your product with extensibility in mind-even if you don’t launch APIs yet. Use microservices, document your data model, and design for future partners.

It’s fascinating how deeply the product vs. platform dichotomy mirrors the tension between simplicity and scale in human systems-whether we’re talking about fintech or philosophy. A product is like a single note held perfectly in tune; it resonates because it doesn’t try to harmonize with everything else. A platform, though? That’s the entire orchestra tuning itself in real time, each instrument dependent on the others. The beauty is in the chaos, but the danger is in the noise. Most founders romanticize platforms because they sound like legacy-building machines, but few realize that true network effects aren’t engineered-they’re organic, like moss growing on a stone. You can’t force it. You can only create the right conditions: trust, clarity, and a reason for people to show up together. And even then, it takes years. Maybe that’s why the hybrid model feels so honest-it admits we don’t have to choose between purity and power. We can be both: simple on the surface, complex beneath, like a river that looks calm but carries the weight of mountains.

Look, if you’re building a fintech and you’re not thinking API-first from day one, you’re already behind. The product-vs-platform debate is a red herring-what matters is composability. You want to win? Build modular, stateless, idempotent services that can be stitched together by devs who don’t give a shit about your UI. Stripe didn’t win because they had a clean dashboard-they won because their API was the most reliable, well-documented, and predictable thing in the entire ecosystem. Every other fintech is just re-implementing the same 12 endpoints with worse error handling and a prettier color scheme. And don’t even get me started on ‘hybrid’-that’s just corporate speak for ‘we don’t know what we’re doing yet.’ If you’re not exposing a public API in your MVP, you’re not building a scalable business. You’re building a glorified form.

Oh wow. Another ‘thoughtful’ essay on fintech architecture that reads like a McKinsey intern’s midterm. Let me guess-you think ‘platform’ sounds more sophisticated than ‘product’? Congrats, you’ve just reinvented the wheel with a PowerPoint slide. The real problem? You’re all still stuck in 2018. Nobody cares about your ‘network effects’ or ‘multi-tenancy’ unless you’re Stripe, Plaid, or a bank with a $200M budget. Most startups? They’re just trying to get 500 users to stop unsubscribing after their first deposit. You don’t need a platform. You need a product that doesn’t crash, doesn’t leak data, and doesn’t make users feel like they’re filling out a tax form. And if your ‘hybrid’ model means you’re hiding a dumpster fire under a pretty UI? Congrats, you’re the next Revolut. Or worse-you’re the one who got acquired for $10M and then quietly shut down because no one actually used the ‘platform.’

I think the hybrid model is the quiet winner. 😊