Options Trading: How to Use Contracts, Strikes, and Expiries to Control Risk and Reward

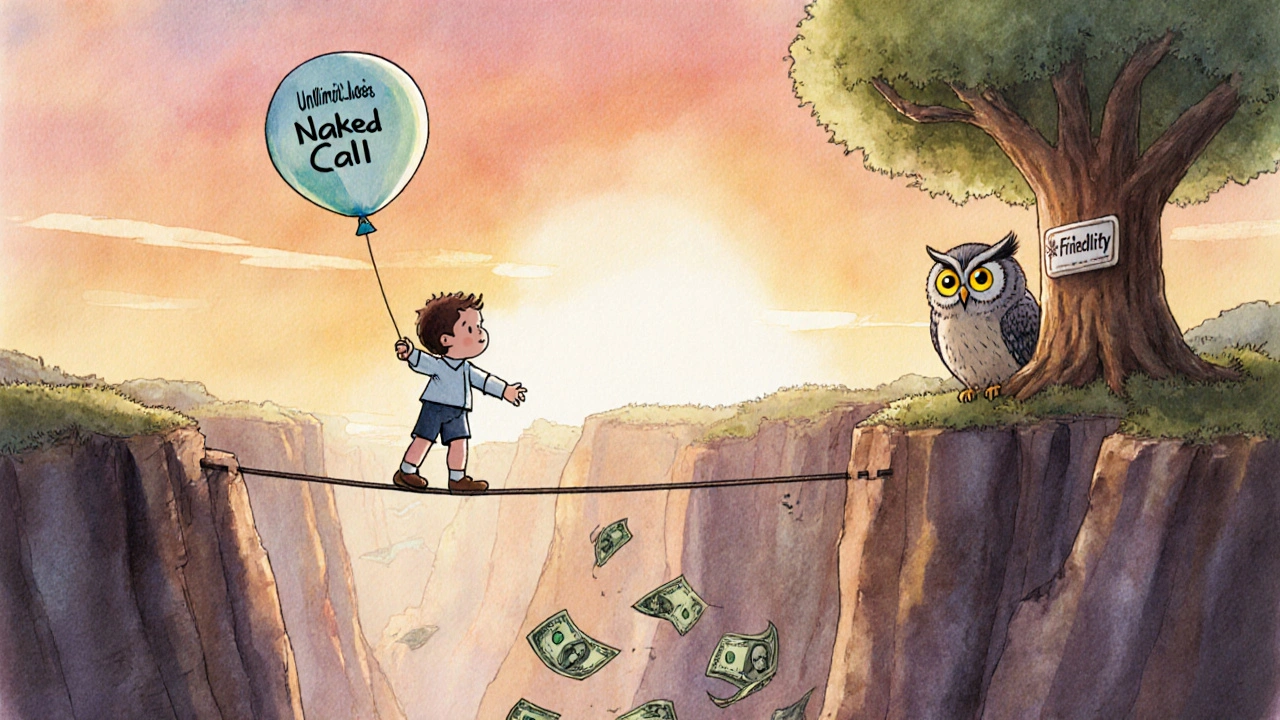

When you trade options trading, a financial strategy that lets you buy or sell the right—but not the obligation—to trade an asset at a set price before a specific date. Also known as derivative trading, it’s not about predicting the future—it’s about setting up rules that protect you if the market moves wrong, and let you profit if it moves right. Unlike buying stock outright, options let you control 100 shares with a fraction of the cash, which means your risk is capped from day one. But that same leverage can turn small mistakes into big losses if you don’t understand what drives the price of an option itself.

The real game in options trading, a financial strategy that lets you buy or sell the right—but not the obligation—to trade an asset at a set price before a specific date. Also known as derivative trading, it’s not about predicting the future—it’s about setting up rules that protect you if the market moves wrong, and let you profit if it moves right. isn’t just picking a stock. It’s picking the right strike price, the fixed price at which the underlying asset can be bought (call) or sold (put) when the option is exercised. Too close to the current price? You pay more. Too far out? The option might expire worthless. Then there’s the expiration date, the last day an option can be exercised before it becomes worthless. Most retail traders lose money because they hold options too long, hoping for a miracle move. But time is the enemy—it erodes value every single day. And behind all of it is implied volatility, a measure of how much the market expects the stock to swing in the near future, priced into the option’s cost. High volatility means higher option prices—not because the stock will go up, but because the chance of a big move is higher. That’s why options on Tesla or NVIDIA cost more than options on Coca-Cola.

You won’t find any of this in the flashy ads promising "easy money." But you will find it in the posts below. These aren’t theory pieces. They’re real breakdowns of how fees, taxes, and portfolio structure affect your options trades. You’ll see how to use options to hedge a stock you already own, how to avoid tax traps when rolling contracts, and why your broker’s commission structure might be eating your profits before you even open a trade. This isn’t about getting rich quick. It’s about building a repeatable system that works even when the market doesn’t cooperate.