Level 5 Options: What They Are, Who Uses Them, and Why Most Traders Avoid Them

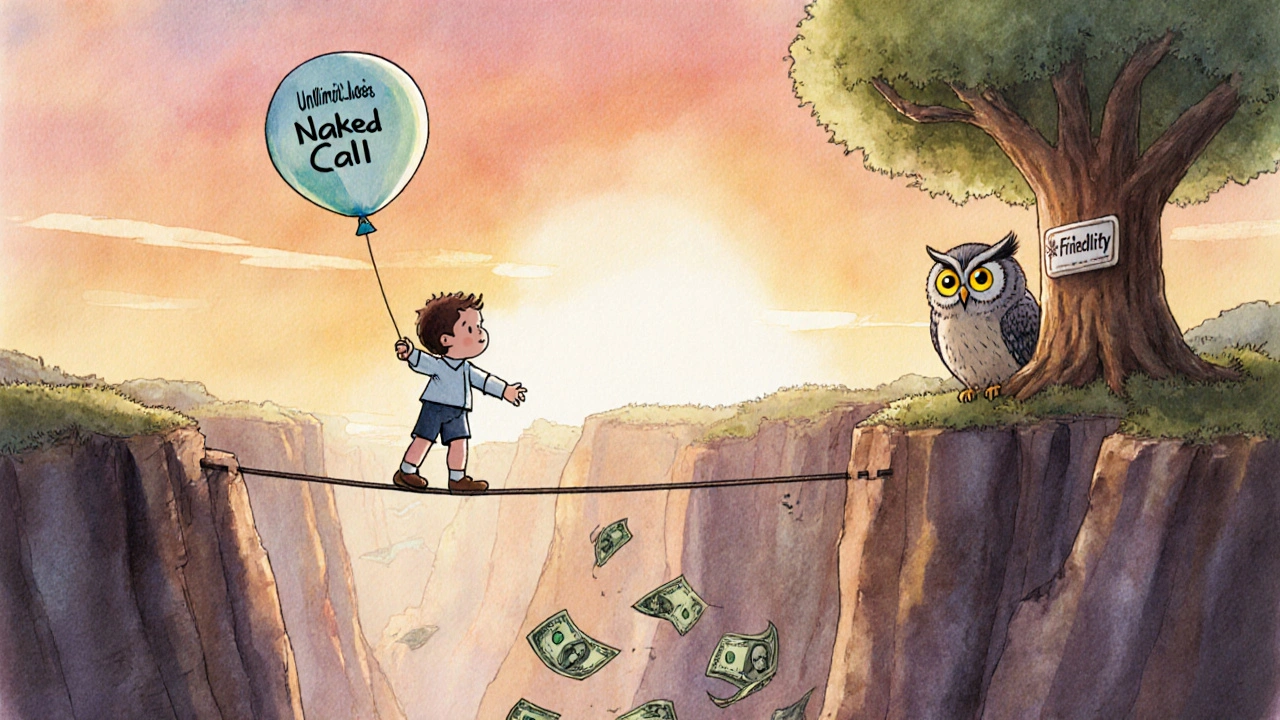

When you hear level 5 options, the highest tier of options trading approval granted by brokers to experienced traders with significant capital and knowledge. Also known as options level 5, it enables trades like naked puts, spreads, and multi-leg strategies that most retail investors never touch. This isn’t just a checkbox on your brokerage app—it’s a license to play with fire. Brokers don’t hand this out lightly. You need to pass exams, show proof of trading history, and often maintain a minimum account balance. And even then, many who get it don’t use it wisely.

Level 5 options encompass complex strategies like iron condors, calendar spreads, and ratio spreads—all of which rely on precise timing and volatility forecasts. These aren’t for guessing market direction. They’re for betting on how much the market will move, or how fast time will erode value. That’s why they tie directly to option expiration, the date when an options contract becomes worthless if not exercised. Most traders lose money because they ignore time decay, the slow, inevitable loss of an option’s value as it nears expiration. Level 5 traders know this isn’t a bug—it’s the feature. They build positions that profit from time falling away, not rising.

But here’s the catch: level 5 options don’t guarantee profits. They just give you more ways to lose money fast. One wrong move in a volatile market can wipe out months of gains. That’s why the posts in this collection focus on what really matters: risk control, position sizing, and knowing when to walk away. You’ll find real breakdowns of how traders use options strategy, structured approaches to entering and managing options trades for specific market conditions. to survive, not just trade. You’ll also see how options risk, the potential for loss from leverage, volatility, and time decay in options positions. isn’t theoretical—it’s daily reality for those who push past level 3.

These aren’t beginner guides. They’re for traders who’ve already lost money on single options, who’ve watched their positions vanish before expiration, and who now want to trade smarter—not harder. You’ll learn how to spot when a level 5 strategy is actually a trap, how to structure spreads that don’t require perfect timing, and why some of the most successful traders never use naked options at all. This isn’t about chasing high returns. It’s about staying in the game long enough to let compounding work.