Trust vs TOD: Which Is Better for Passing Assets Without Probate?

When you’re planning how to pass your money or property to loved ones after you’re gone, two common tools come up: a trust, a legal arrangement where a trustee holds and manages assets for beneficiaries. Also known as a living trust, it lets you control how and when assets are distributed, even after death. And then there’s the Transfer on Death (TOD) designation, a simple way to name a beneficiary who automatically gets an account like a brokerage or bank account when you die, skipping probate entirely. Both avoid probate—but they work in very different ways, and choosing the wrong one can cost your family time, money, or even trigger unintended taxes.

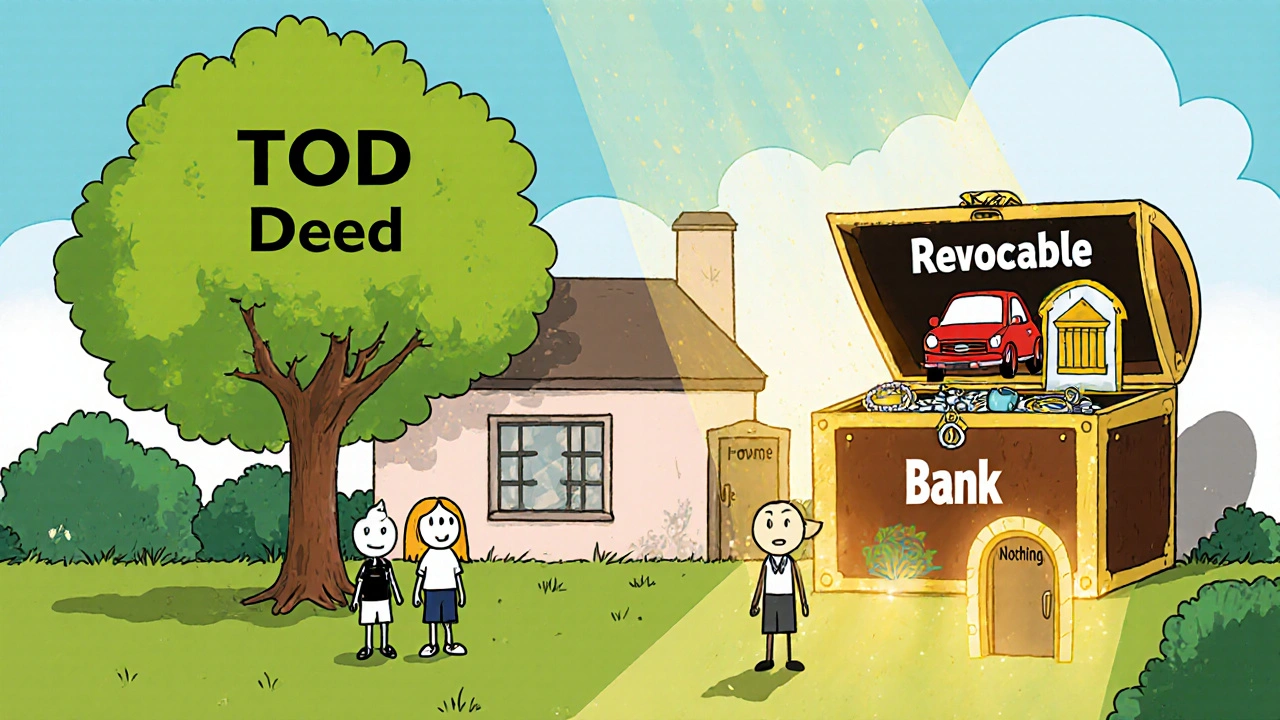

Here’s the real difference: a trust gives you control over more than just accounts—it can cover real estate, vehicles, business interests, and even set conditions like "my child gets $10,000 at age 25." A TOD only works on specific financial accounts: brokerage accounts, bank CDs, or sometimes even vehicles in certain states. You can’t put your house in a TOD unless your state allows it for real estate, and even then, it’s rare. Trusts also protect assets from creditors and can manage money for minors or people with special needs. TODs? They’re straightforward but fragile—if your beneficiary dies before you, or if you forget to update them, the asset could still end up in probate. Plus, if you have multiple beneficiaries with different needs, a TOD can’t split assets fairly—it just hands everything to whoever’s named.

And here’s something most people miss: taxes. A trust can be structured to reduce estate taxes for larger portfolios, especially if you’re over the federal exemption ($13.61 million in 2024). A TOD doesn’t help with that at all—it just changes who gets the money, not how much the estate pays in taxes. Also, if you’re using a TOD on a retirement account like an IRA, you’re still stuck with the IRS rules on required minimum distributions. A trust, if set up right, can stretch those out over a beneficiary’s lifetime.

So who uses what? If you’ve got a simple portfolio—just a brokerage account and a savings account—and you want your spouse or kid to get it fast with zero paperwork, a TOD is fine. But if you own property, have complex family dynamics, want to protect assets from divorce or lawsuits, or you’re trying to minimize estate taxes, a trust is the only tool that gives you real control. And if you’re unsure? Many people use both: a trust for big-ticket items and TODs for smaller accounts as a backup.

Below, you’ll find real breakdowns from people who’ve used both. Some saved thousands in legal fees by choosing the right path. Others lost months in court because they assumed a TOD was enough. These posts don’t sell you on theory—they show you what actually happened when people made these choices, and what they wish they’d known sooner.