Options Risk: Understand the Real Dangers in Options Trading

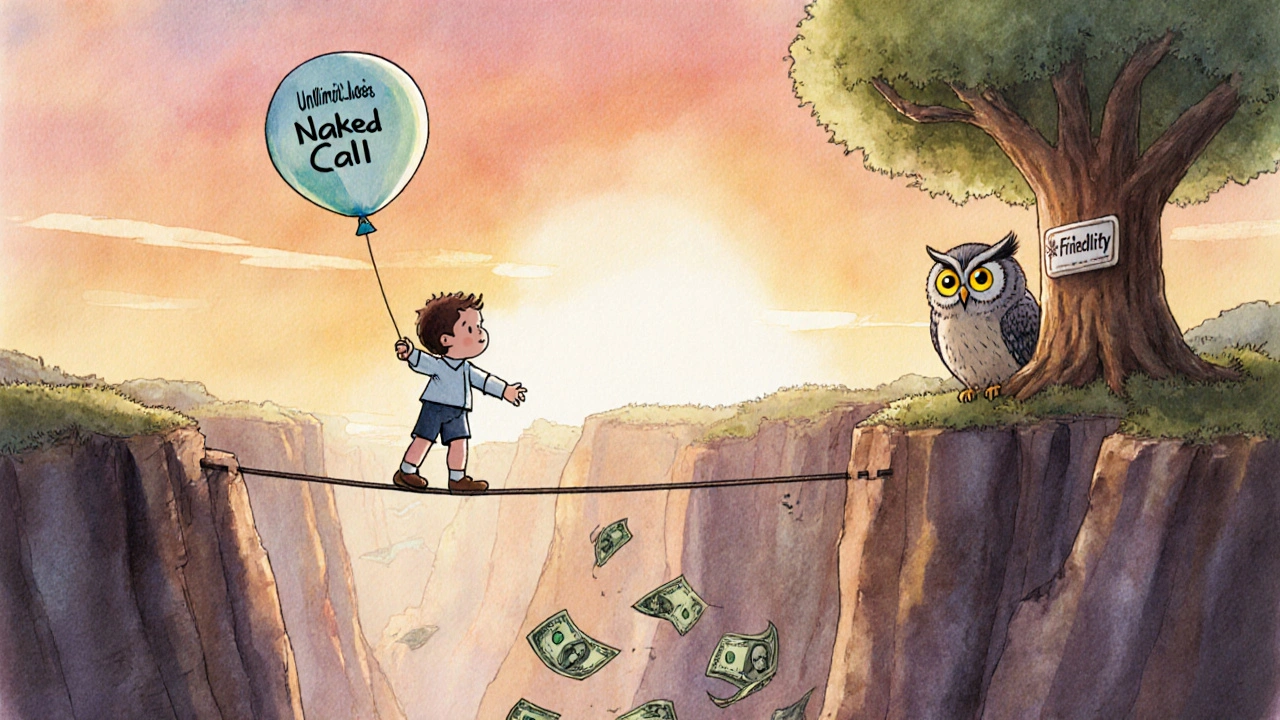

When you trade options risk, the potential for rapid loss in derivative contracts tied to underlying assets like stocks or ETFs. Also known as options trading danger, it’s not just about being wrong on direction—it’s about losing money even when you’re right, because time and volatility work against you. Most people think options are just leveraged stocks. They’re not. They’re ticking clocks with moving parts that most traders never learn to read.

One of the biggest killers in options trading is time decay, the steady erosion of an option’s value as it nears expiration. It doesn’t care if the stock goes your way—if it doesn’t move fast enough, your option loses value daily. That’s why 0DTE options, which expire in a single day, are so dangerous. A $100 stock might jump to $105, but if your call option expires in 4 hours and the move happened too late, you’re left with zero. option expiration, the fixed date when an options contract becomes worthless if not exercised isn’t just a deadline—it’s a financial cliff.

Then there’s volatility risk, the sudden, unpredictable swings in market uncertainty that can blow up or boost an option’s price overnight. You might buy an option because a stock is calm, only to see earnings or a Fed announcement send volatility soaring—and your option still loses because the price didn’t move in your direction fast enough. This isn’t gambling. It’s math you’re ignoring. The posts below show real examples: how time decay eats away at trades, why 0DTE options are traps for beginners, and how even experienced traders get burned by misjudging volatility. You’ll also find breakdowns of how fees, spreads, and liquidity add hidden costs that crush returns. No fluff. No hype. Just what actually happens when you trade options in the real world.