Naked Options: What They Are, Why They're Risky, and How Traders Use Them

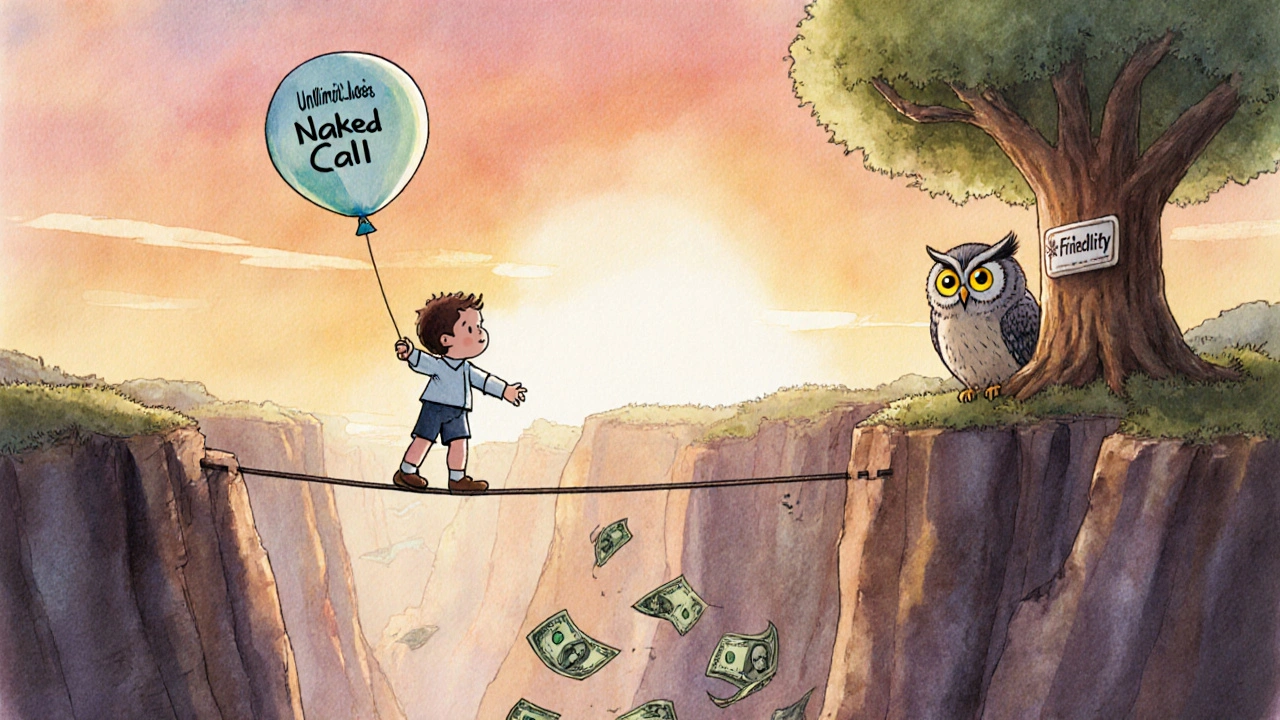

When you sell a naked option, a trade where you sell an option contract without owning the underlying asset or having a hedge in place. Also known as uncovered option, it’s one of the most dangerous strategies in options trading because your potential loss is unlimited. Unlike covered calls, where you own the stock and sell call options against it, naked options leave you exposed to wild price swings. If you sell a naked call and the stock rockets up, you have to buy it at market price to fulfill the contract—no matter how high it goes. Same goes for naked puts: if the stock crashes, you’re forced to buy it at the strike price, even if it’s worth half that.

People try naked options because they promise quick cash from premiums. But the math doesn’t work in your favor. Most options expire worthless, sure—but when they don’t, they wipe out months of gains. A single big move can cost you more than your entire account. And it’s not just about direction. Time decay works against you here too. As expiration nears, the option’s value drops fast—but if the market turns, that decay can’t save you. You’re not just betting on price—you’re betting on calm. And markets rarely stay calm when you’re short options without protection.

This isn’t just theory. Look at the traders who lost everything during the 2021 meme stock surge. Many sold naked calls on GameStop or AMC, thinking the price wouldn’t go higher. It did. And they got crushed. Even seasoned traders avoid naked options unless they’re hedged with other positions or have a clear exit plan. The posts below show you how real traders manage risk, what alternatives actually work, and why most people should stay away from naked options entirely. You’ll find guides on covered strategies, how to use puts for protection, and why timing expiration matters more than you think. No fluff. Just what happens when you trade without a safety net—and what to do instead.