Fintech Strategy: How Data, Regulation, and Tech Drive Real Financial Edge

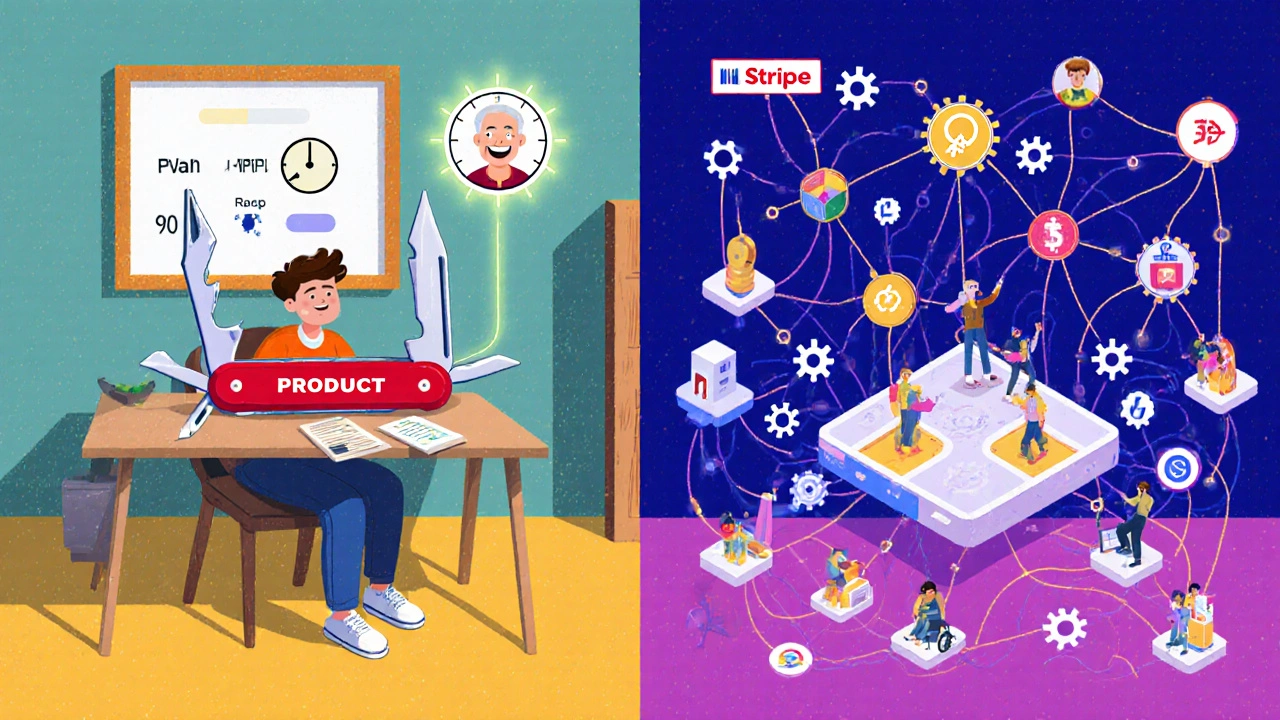

When you hear fintech strategy, a deliberate plan to use technology, data, and regulation to create lasting financial advantage. Also known as digital finance planning, it’s not about flashy apps or quick wins—it’s about building systems that keep working even when markets shift, regulators change rules, or competitors copy your features. The best fintech strategies don’t rely on one product. They layer data moats, regulatory compliance, and automated infrastructure so that every customer interaction, every transaction, and every risk check becomes a strength—not a cost.

At the core of any strong fintech strategy, a deliberate plan to use technology, data, and regulation to create lasting financial advantage. Also known as digital finance planning, it’s not about flashy apps or quick wins—it’s about building systems that keep working even when markets shift, regulators change rules, or competitors copy your features. is the data moat, a competitive advantage built on unique, proprietary, and continuously growing customer data that others can’t replicate. Companies like Klarna or Stripe didn’t win because they had better interfaces—they won because they collected payment behavior, spending patterns, and risk signals across millions of users. That data trains smarter fraud models, predicts cash flow, and personalizes offers at scale. Without it, even the slickest app is just another tool in a crowded market.

Then there’s RegTech, technology that automates financial compliance to reduce cost, errors, and regulatory risk. Most people think compliance is a burden. But the smartest fintechs treat it as a product feature. RegTech cuts false alerts by 90%, slashes audit time, and turns legal requirements into customer trust. It’s why banks can offer instant loans while staying compliant with AML rules, and why NGOs can accept global donations without breaking anti-fraud laws. This isn’t optional anymore—it’s the baseline for survival.

And underneath it all is financial infrastructure, the hidden systems that process payments, manage risk, and keep services running during traffic spikes or market crashes. Think autoscaling during Black Friday, chaos engineering to test system failures, or floating-rate notes protecting portfolios from rate hikes. These aren’t glamorous—but when your app crashes at checkout or your bond fund loses 20% because no one checked the spread risk, you’ll wish you’d invested in this stuff earlier.

You’ll find posts here that show how these pieces connect. How embedding insurance at checkout isn’t just a feature—it’s a distribution moat. How style rotation works because market regimes shift, not because someone guessed right. How tax-deferred annuities and floating-rate notes aren’t just products—they’re tools in a larger strategy to protect returns when rates rise. And how even something as simple as an annual portfolio checkup becomes a strategic lever when you cut hidden fees and optimize taxes.

This isn’t a list of tools. It’s a look at how the winners build systems that last. Whether you’re managing a portfolio, running a startup, or just trying to make smarter money moves, the same rules apply: data beats guesswork, compliance beats risk, and infrastructure beats hype. Below, you’ll see real examples of how these ideas play out—in trading, in banking, in insurance, and in the lives of everyday investors.