Fintech Product: What It Is and How It’s Changing How You Manage Money

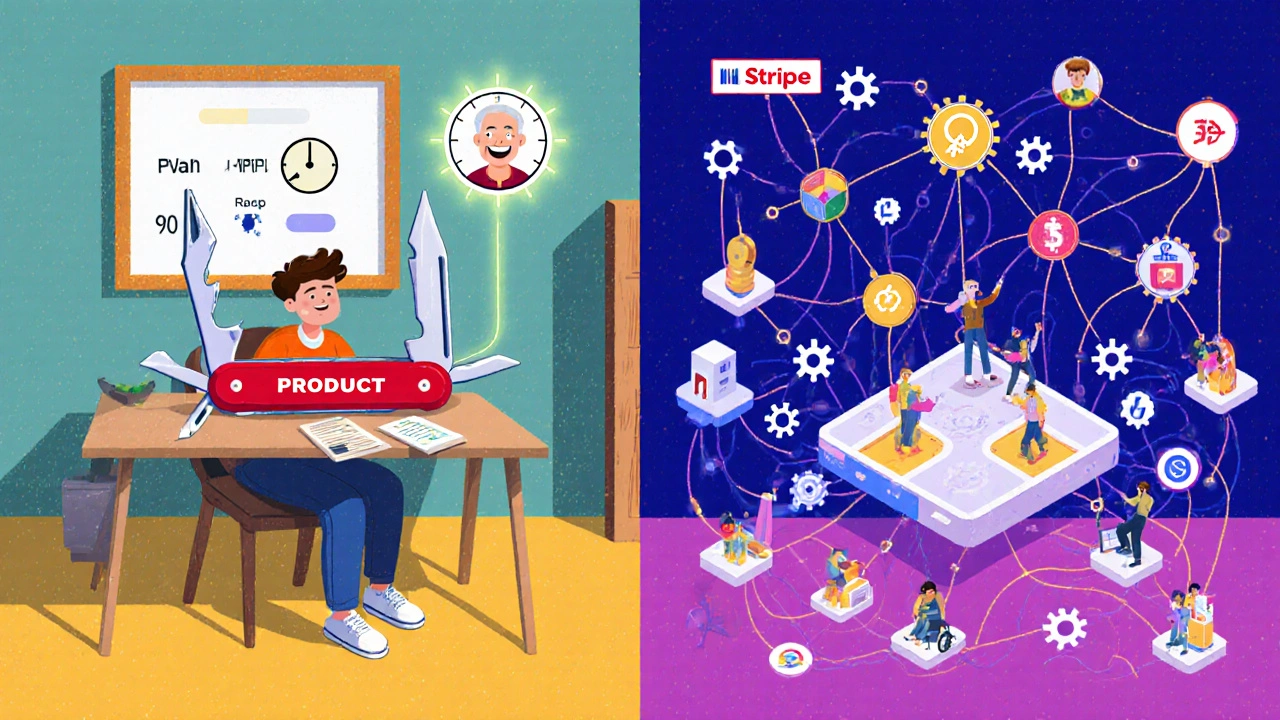

When you use a mobile app to send money, get a loan in minutes, or buy insurance while checking out online, you’re using a fintech product, a digital tool that delivers financial services faster, cheaper, and more simply than traditional banks. Also known as financial technology, it’s not just apps—it’s the backbone of how money moves today.

Fintech products don’t exist in a vacuum. They rely on payment systems, the invisible networks that process transactions between banks, merchants, and consumers, and they’re shaped by compliance automation, software that helps companies follow complex financial rules without hiring dozens of lawyers. You see this in RegTech tools that cut false fraud alerts by 90%, or in embedded insurance that adds coverage at checkout without paperwork. These aren’t gimmicks—they’re replacements for outdated systems that took days, not seconds.

What makes a fintech product stick? It solves a real pain point. Take BNPL services: they used to skip credit checks, but now they report to credit bureaus because users need to build credit, not just spend. Or look at open banking APIs replacing screen scraping—secure data access isn’t optional anymore, it’s the law. Even small businesses benefit: interchange fees are being challenged, and merchants now have tools to negotiate them. Fintech isn’t about flashy features. It’s about removing friction: hidden fees, slow approvals, opaque terms.

Behind every good fintech product is data, distribution, and regulation. The winners aren’t the ones with the prettiest app—they’re the ones who own the data flow, control the customer touchpoints, and stay ahead of rules. That’s why companies like Klarna, Stripe, or Plaid aren’t just tech firms—they’re financial infrastructure. And if you’re using a robo-advisor, a fractional stock broker, or a digital wallet, you’re already part of that system.

What you’ll find below isn’t a list of tools. It’s a map of how fintech products actually work in the real world. From how autoscaling keeps platforms alive during Black Friday spikes, to how chaos engineering prevents bank outages, to how embedded insurance converts 50% of shoppers into buyers—these posts cut through the hype. You’ll learn what’s changing, what’s staying the same, and what you should care about right now.