Fintech Platform: How Digital Financial Tools Are Changing How We Invest and Manage Money

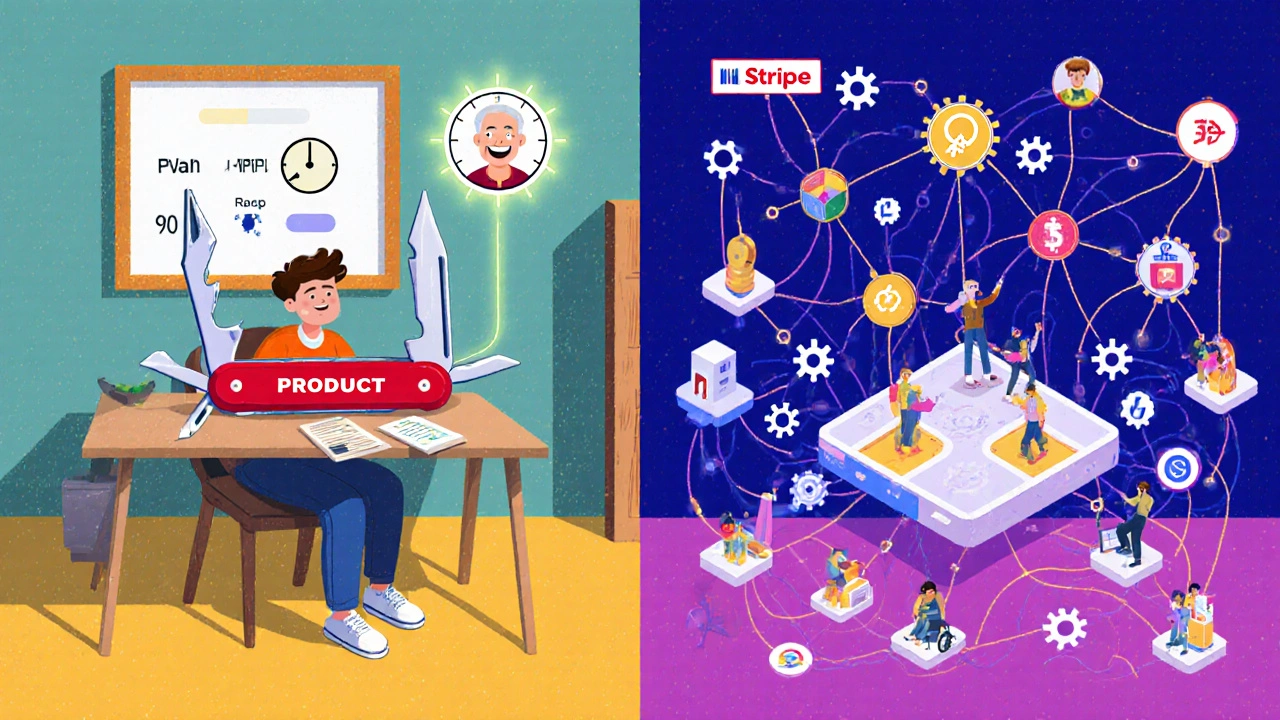

When you use a fintech platform, a digital service that delivers financial products like payments, lending, or investing through software instead of traditional banks. Also known as financial technology, it’s not just apps—it’s the hidden infrastructure behind your mobile brokerage, BNPL checkout, and automated tax tools. This isn’t science fiction. It’s what’s replacing branch visits, paper statements, and slow wire transfers. A fintech platform doesn’t just make things faster—it changes who gets access to money, how risk is measured, and who profits from your financial behavior.

Behind every good fintech platform are three things: open banking, a system that lets you securely share your financial data with third-party apps without giving out your login, compliance automation, software that tracks regulations like AML and KYC so companies don’t get fined millions for human error, and secure APIs, the clean, encrypted connections that replace risky screen scraping. These aren’t buzzwords—they’re the reason you can now link your bank account to an investment app in 30 seconds, get a loan offer within minutes, or see your portfolio’s tax impact before you sell. Without them, fintech would still be stuck in the login-sharing dark ages.

What you’re seeing today isn’t just convenience. It’s a structural shift. Fintech platforms are built on data moats—companies that collect more usage patterns than banks ever could—and regulatory moats, where compliance costs scare off small players. That’s why only a few dominate. They don’t just offer better apps—they control the pipes. And if you’re using a service that asks for your bank password, you’re on the wrong side of that shift.

Below, you’ll find real-world breakdowns of how these systems work—whether it’s how embedded insurance sneaks into your phone purchase, why RegTech cuts compliance costs by half, or how chaos engineering keeps fintech apps from crashing during Black Friday. No fluff. No theory. Just what’s actually happening in the code, the regulations, and the wallets of everyday users.