Fintech Business Model: How Data, Distribution, and Regulation Drive Profit

At its core, a fintech business model, a system for creating, delivering, and capturing value in financial services using technology. Also known as digital finance platform, it doesn’t just replace banks—it rebuilds how money moves, who controls it, and who profits. Most fintech startups fail because they think a slick app is enough. But the winners? They’ve built moats—barriers that keep others out. These aren’t patents or trademarks. They’re data moats, the exclusive access to real-time financial behavior that lets firms predict risk, tailor offers, and automate decisions better than anyone else. Think of it like this: if you know how someone spends, saves, and borrows across apps, banks, and bills, you can offer them a loan before they even ask. That’s not magic. It’s data.

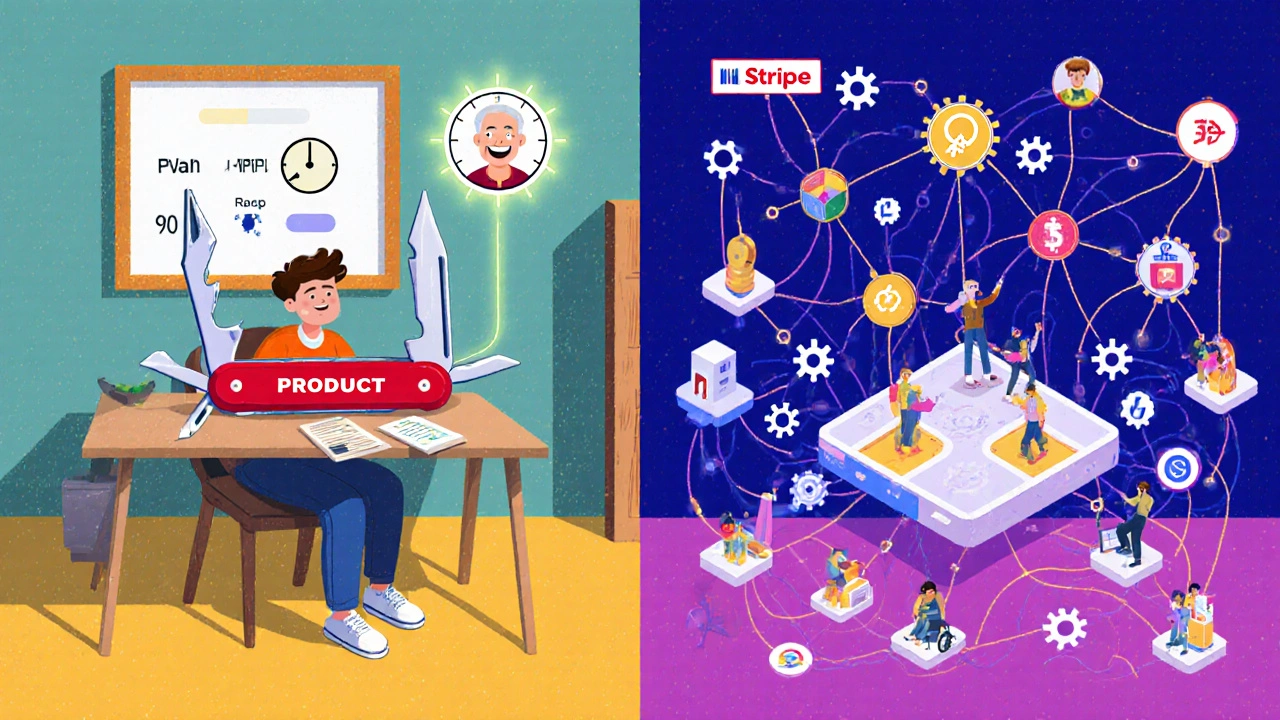

Then there’s the distribution moat, how deeply a fintech is woven into daily life through partnerships, embedded features, or seamless user flows. You don’t need users to download your app if your credit option pops up at checkout, your insurance is bundled with a phone purchase, or your payment tool is already inside a farmer’s mobile app in Kenya. That’s how companies like Klarna, Stripe, and Agri-fintech platforms grow without spending millions on ads. Distribution isn’t about reach—it’s about being unavoidable.

And then there’s the quiet giant: the regulatory moat, the cost and complexity of compliance that makes it nearly impossible for new entrants to catch up. RegTech tools don’t just save money—they create barriers. Companies that spent years building automated AML checks, model governance systems, and audit trails aren’t just compliant—they’re untouchable. A small startup can’t replicate that overnight. That’s why firms like Plaid and Synapse survive even when their user growth slows. They’re not selling software. They’re selling trust, baked into regulation.

These three moats—data, distribution, regulation—are the hidden engines behind every successful fintech. They’re why a company like Chime can offer fee-free banking while others struggle. Why embedded insurance converts 50% of shoppers at checkout. Why chaos engineering isn’t just a tech buzzword—it’s a requirement to keep the system running when regulators are watching. And why a simple BNPL service now impacts your credit score: because the business model isn’t just about selling credit—it’s about owning the data trail it leaves behind.

You’ll find posts here that dig into each layer. How interchange fees shape merchant behavior. How RegTech cuts compliance costs by half. How screen scraping is dying because APIs are safer, smarter, and harder to copy. How NGOs use fintech to move money without breaking rules. These aren’t random stories. They’re pieces of the same puzzle: how fintechs turn technology into lasting advantage. What you’ll see below isn’t a list of tools. It’s a map of how real money moves—and who gets to keep it.