Estate Planning: How to Protect Your Assets and Leave a Clear Legacy

When you think about estate planning, the process of arranging how your assets will be managed and distributed after your death. Also known as succession planning, it's not about dying—it's about making sure the people you care about don’t end up in court, confused, or broke. Most people delay it because they think they don’t have enough to protect. But even if you own a house, a car, a retirement account, or just a few thousand in savings, skipping estate planning means the state decides what happens to it—and that’s rarely what you’d want.

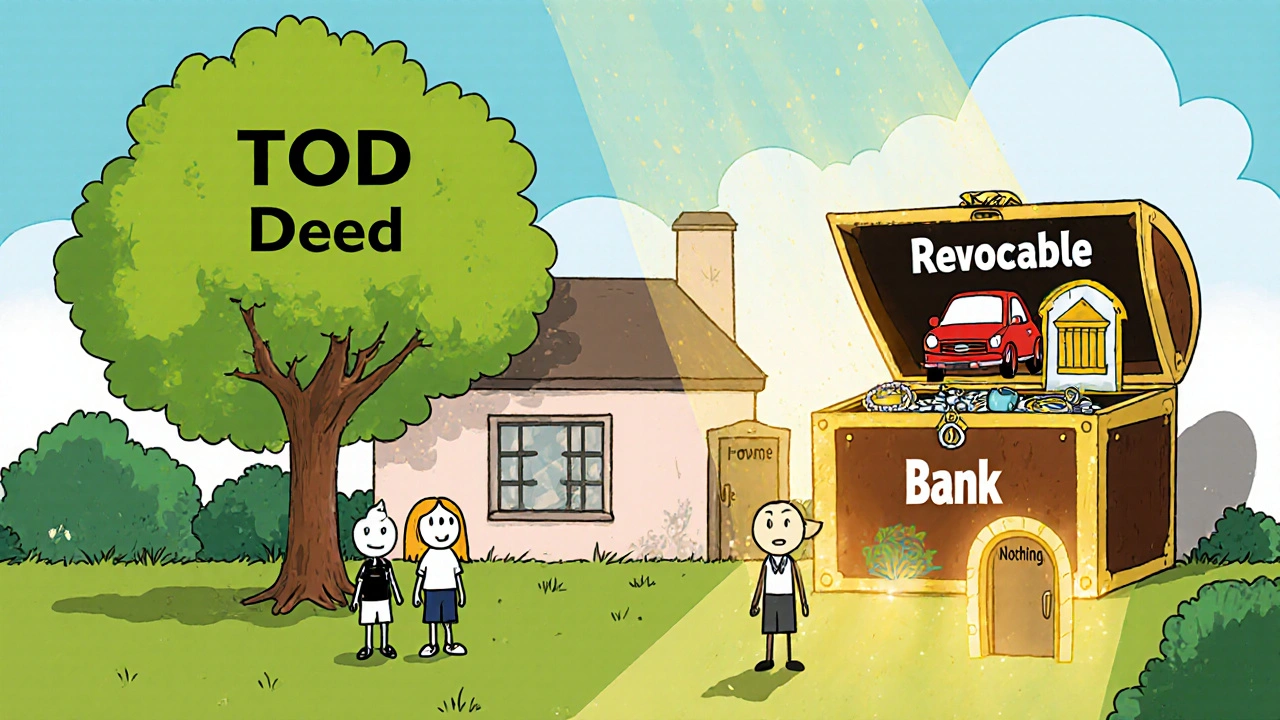

Wills, a legal document that names who gets what after you pass are the starting point, but they’re not enough on their own. If your estate goes through probate, the court-supervised process of validating a will and distributing assets, it can take months or even years, and your family will pay fees that could’ve been avoided. That’s where trusts, legal structures that hold assets outside of your name to bypass probate come in. Trusts give you control over when and how beneficiaries get money—like keeping it locked up until a child turns 25, or spreading payments over time instead of handing over a lump sum. And if you have minor kids, naming a guardian in your will is the only way to make sure someone you trust raises them, not a judge.

What you don’t see in your bank statement matters just as much. Life insurance payouts, retirement accounts, and joint bank accounts all have beneficiaries that override your will. If you named an ex-spouse as your 401(k) beneficiary ten years ago and never updated it, they’ll get the money—even if you’re remarried and have kids. Updating beneficiaries is faster than writing a will, and just as critical. Tax implications also play a role. Some assets, like Roth IRAs, pass tax-free. Others, like traditional retirement accounts, trigger income taxes for heirs. Without planning, your loved ones could owe thousands in taxes they didn’t expect.

You’ll find posts here that break down how to review your investment policy statement for estate purposes, how tax-deferred annuities fit into long-term legacy planning, and how to spot hidden fees that eat into what you leave behind. There’s no one-size-fits-all plan, but there are clear steps you can take right now to avoid chaos later. This isn’t about fancy lawyers or million-dollar portfolios. It’s about clarity, control, and care—for the people who’ll still be here when you’re not.