Finance: Understand Investing, Estate Planning, and Brokerage Choices

When you think about finance, the management of money, investments, and assets to build long-term wealth. Also known as personal finance, it's not just about saving—it's about making smart moves with what you have so it works harder for you over time. Whether you're protecting your family’s future or picking a broker to buy stocks, finance is the system behind every financial decision you make.

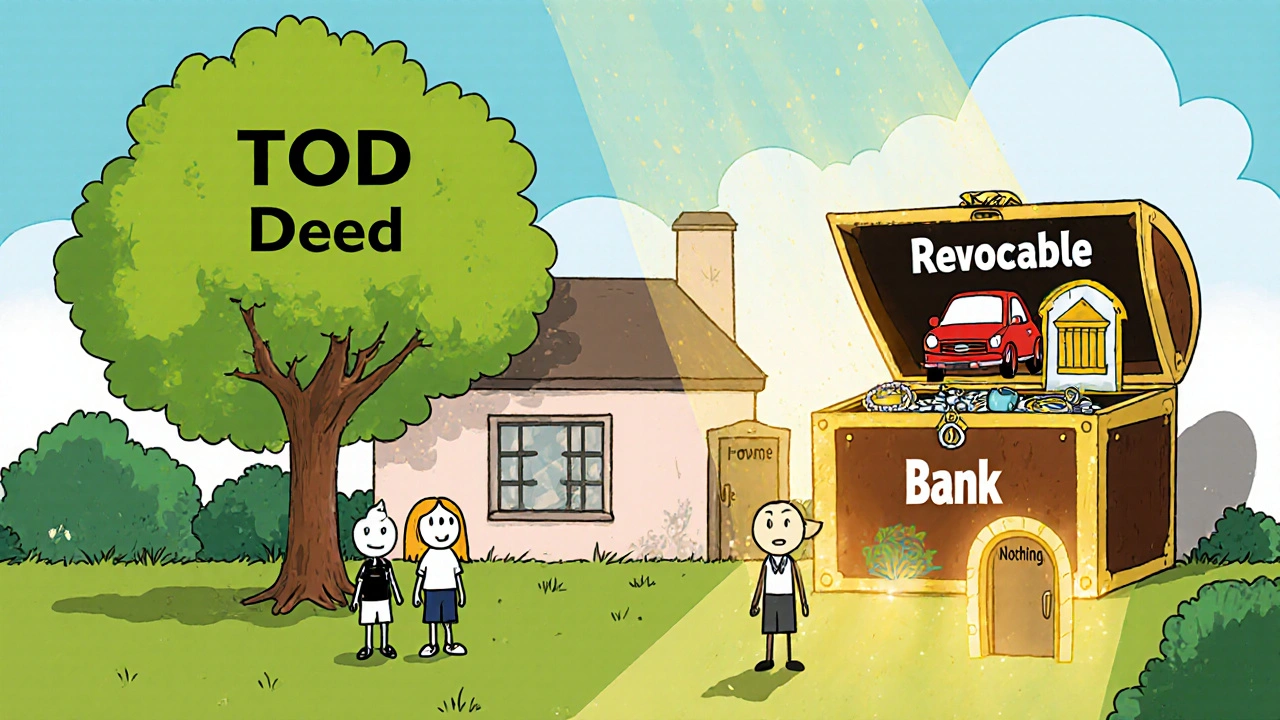

Two big pieces of finance that often get mixed up are estate planning, how you decide who gets your assets after you're gone and brokerage services, the platforms or advisors that help you buy and sell investments. You don’t need a lawyer to start, but knowing the difference between a trust, a legal tool that lets you control how and when assets are passed on and a Transfer on Death deed, a simple form that transfers property automatically at death can save your family thousands in fees and stress. Same goes for choosing between a discount broker, a low-cost platform for self-directed investors and a full-service broker, a firm that offers advice, planning, and hands-on help. One isn’t better—it’s about what fits your life right now.

Finance isn’t about getting rich overnight. It’s about building systems that keep working even when you’re not watching. That means knowing when to use a trust instead of a TOD deed, when to pay for advice and when to go solo, and how fees eat into your returns over time. The posts here cut through the noise. You’ll find real comparisons—not theory, not hype—just what works for people like you. No jargon. No fluff. Just clear choices that help you keep more of what you earn.