Transfer on Death: How to Pass Assets Smoothly Without Probate

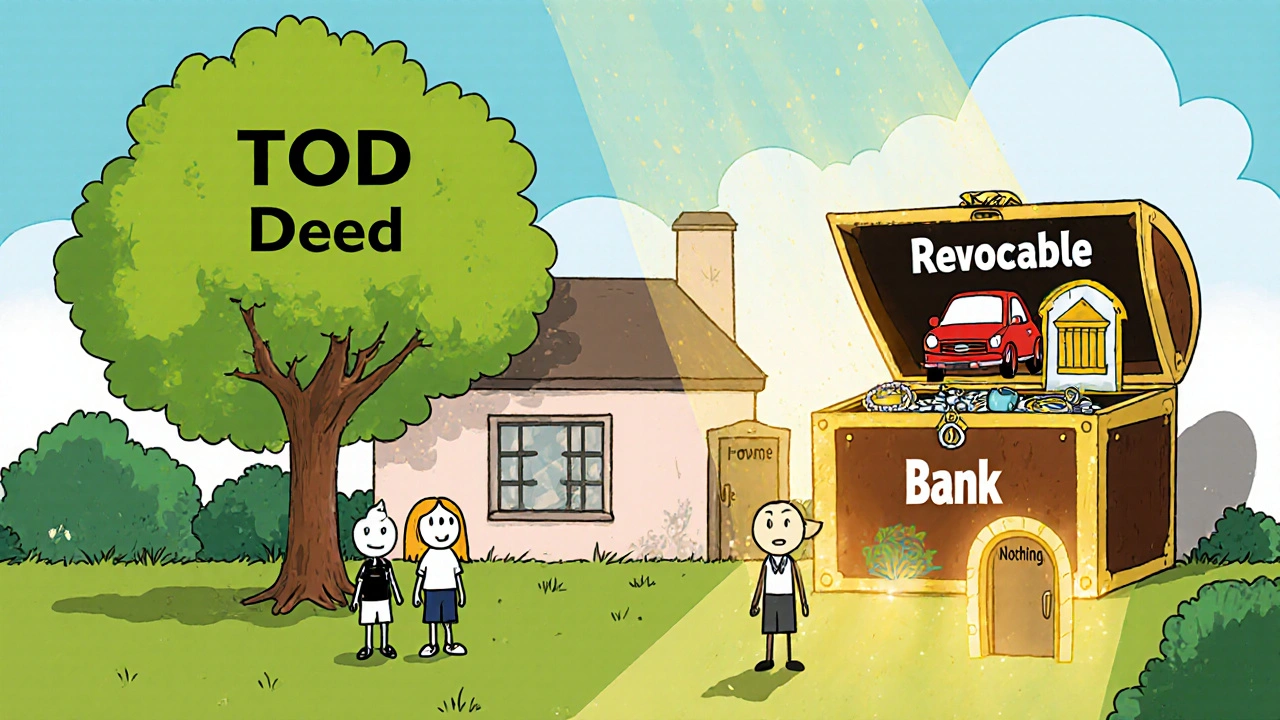

When you set up a transfer on death, a legal designation that lets you name a beneficiary to receive an asset automatically when you die. Also known as POD (payable on death), it’s one of the most straightforward ways to keep your estate out of court. No will. No executor. No months-long wait. Just a simple form, signed and filed, and your money, stocks, or property go straight to the person you choose.

This isn’t just for big estates. A POD bank account, a checking or savings account with a named beneficiary can hold $5,000 or $500,000—it works the same way. Same for transfer on death deeds, a document that transfers real estate without probate. Even brokerage accounts use TOD registration, a way to assign beneficiaries to stocks, ETFs, and bonds. These aren’t fancy tools—they’re practical, low-cost fixes for a broken system. Probate can cost 5% to 10% of an estate in fees and delays. Transfer on death cuts that out entirely.

But it’s not magic. You still need to keep beneficiary forms updated. If you divorce, remarry, or a child passes away, your old designations won’t change automatically. And you can’t use it for everything—retirement accounts have their own rules, and some states limit real estate transfers. Still, when used right, it’s the quiet hero of estate planning. You don’t need a lawyer to fill out a POD form. You don’t need a trust. You just need to act before it’s too late.

Below, you’ll find real-world examples of how people use transfer on death to protect their assets, avoid family fights, and make things easier for those left behind. These aren’t theoretical guides—they’re step-by-step breakdowns from people who’ve been there. Whether you’re holding a brokerage account, own a home, or just want to make sure your savings go to the right person, you’ll find what you need here.