TOD deed: Understanding Transfer-on-Death Designations for Estate Planning

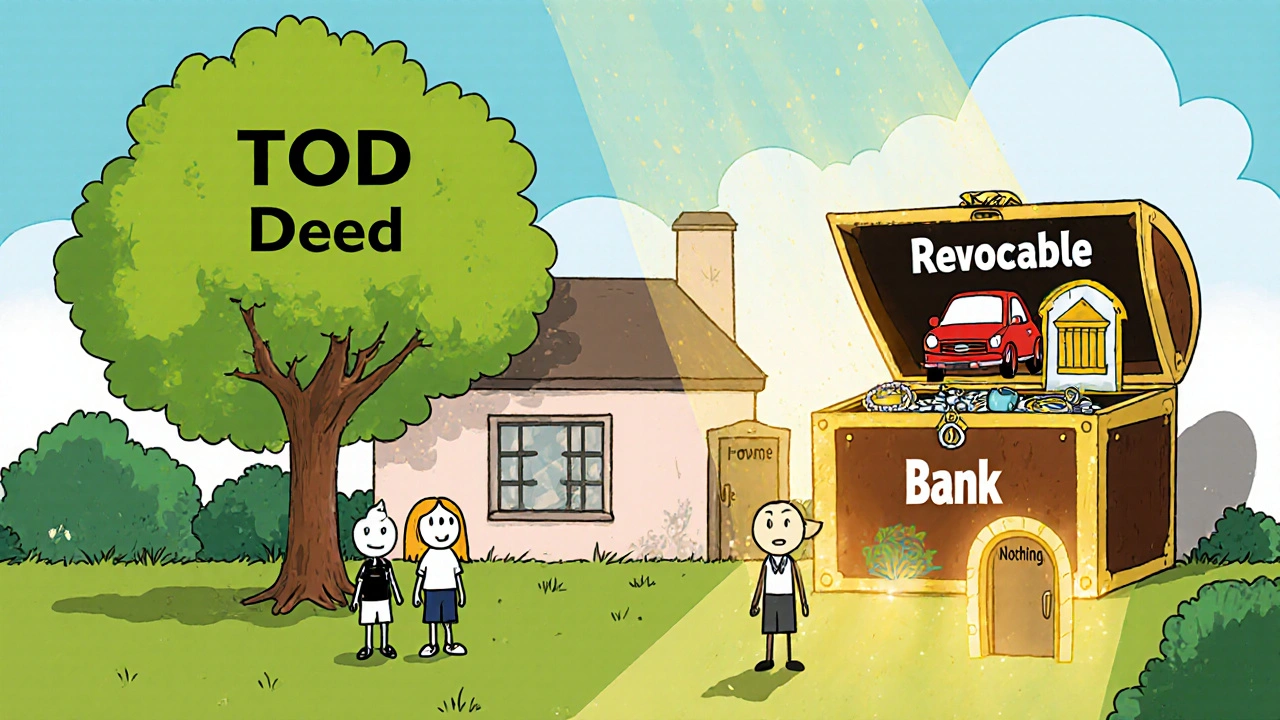

When you own a house, land, or other real property, how it gets passed on after you die matters a lot. A TOD deed, a legal document that transfers real estate directly to a named beneficiary upon the owner’s death, bypassing probate. Also known as a beneficiary deed, it’s a simple, low-cost way to keep your property out of court and in the hands of the people you choose. Unlike a will, which goes through probate and can take months or even years to settle, a TOD deed triggers automatically when you pass away—no court involvement, no delays, no extra fees.

This tool is especially useful if you want to avoid the mess and cost of probate without setting up a full trust. It works alongside other estate planning moves, like naming beneficiaries on bank accounts or retirement funds. But it’s not a replacement for a will—TOD deeds only cover the specific property listed on them. If you have multiple properties, each one needs its own TOD deed. And if your beneficiary dies before you, you’ll need to update it. Many people forget to review these documents after major life changes—divorce, remarriage, or the loss of a loved one—and end up leaving assets to the wrong person.

What makes a TOD deed powerful is how it connects to other parts of your financial life. For example, if you’re using TOD deed to pass on a rental property, you’re also thinking about who’ll manage it, who’ll pay the taxes, and whether your heir can handle the responsibility. It’s not just about ownership—it’s about continuity. That’s why it often shows up in discussions about estate planning, the process of arranging for the management and disposal of a person’s estate during life and after death, and beneficiary designation, the act of naming who receives specific assets like life insurance, retirement accounts, or real estate. These aren’t isolated tools—they’re pieces of a larger system designed to protect your family and simplify things when you’re gone.

You’ll find that many of the posts below explore how people use simple legal tools like the TOD deed to avoid complex financial traps. Some look at how it compares to joint ownership or trusts. Others show how mistakes in naming beneficiaries can cause family fights—or worse, leave assets stuck in court. There’s also advice on when to update your deed, what happens if you move to another state, and how taxes play into the transfer. These aren’t theoretical discussions. They’re real stories from people who’ve been through it—and learned the hard way.

Whether you’re just starting to think about what happens to your home after you’re gone, or you’re trying to fix an old estate plan that no longer fits, the posts here give you the clear, no-fluff facts you need. No lawyers, no jargon, just what works—and what doesn’t.