Revocable Trust: What It Is and How It Fits Into Your Financial Plan

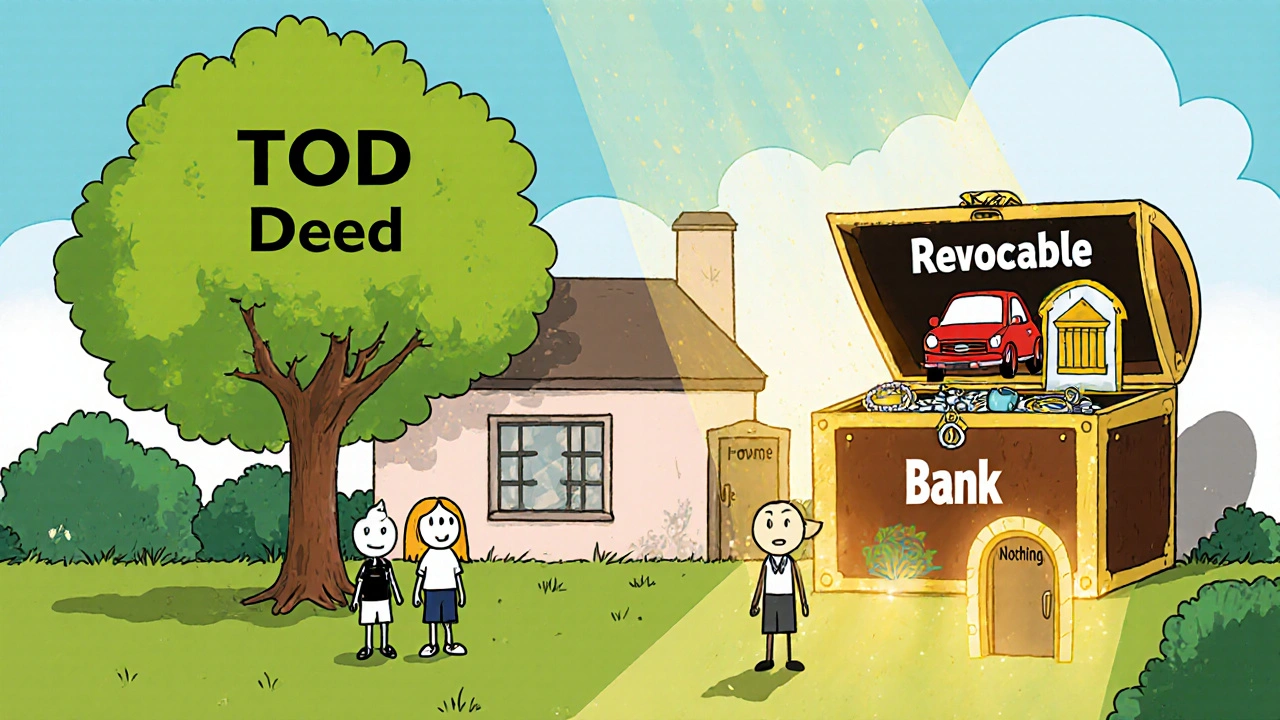

When you set up a revocable trust, a legal arrangement where you transfer ownership of your assets to a trust you can change or cancel at any time. Also known as a living trust, it lets you stay in control while alive and makes sure your money and property go exactly where you want after you’re gone. Unlike a will, which goes through probate court—a slow, public, and often expensive process—a revocable trust skips that entirely. That means your family gets access faster, with less stress and fewer legal fees.

It’s not just about avoiding probate. A revocable trust works hand-in-hand with estate planning, the process of arranging how your assets will be managed and distributed after your death. You name a trustee (often yourself at first, then someone you trust) to manage the trust. You also name trust beneficiaries, the people or organizations that will receive the trust’s assets. This gives you control over who gets what, when, and under what conditions—like waiting until a child turns 25 or spreading payments over years instead of handing over a lump sum.

People often think revocable trusts are only for the wealthy, but that’s not true. If you own a home, have retirement accounts, or want to protect your kids from mismanaging an inheritance, this tool matters. It’s especially useful if you own property in multiple states—each state would require separate probate without a trust. And if you ever become unable to manage your own finances, your successor trustee can step in immediately, avoiding court-appointed guardianship.

What it doesn’t do is protect assets from creditors while you’re alive. That’s a common misunderstanding. If you’re worried about lawsuits or medical bills, you’ll need other tools. But for smooth transitions, privacy, and control, nothing beats a revocable trust. It’s simple to set up, easy to update, and works silently behind the scenes until it’s needed.

Below, you’ll find real-world guides on how to structure a trust, when to update it, how it interacts with wills and powers of attorney, and what happens if you don’t have one at all. These aren’t theory pieces—they’re practical breakdowns from people who’ve been through it, with clear steps and no legal jargon.