Cloud Scaling: How Digital Infrastructure Powers Financial Systems

When you trade stocks at 3 a.m. or send a payment through a mobile app, cloud scaling, the ability of digital systems to automatically adjust computing power based on demand. Also known as elastic computing, it’s what keeps platforms running when millions of users log in at once. Without it, your brokerage app would freeze during earnings season, your crypto exchange would crash when Bitcoin surges, and your budgeting tool would go offline when you check your balance after payday.

Cloud scaling isn’t just about speed—it’s about survival. Fintech companies use it to handle everything from real-time fraud detection to processing thousands of loan applications during a market dip. It works hand-in-hand with system reliability, how consistently a digital service performs under pressure. If your trading platform can’t scale during volatility, it’s not just inconvenient—it’s dangerous. That’s why top platforms combine cloud scaling with chaos engineering, intentionally testing system failures to prevent outages. They don’t wait for crashes to happen; they break things on purpose to fix them before users notice.

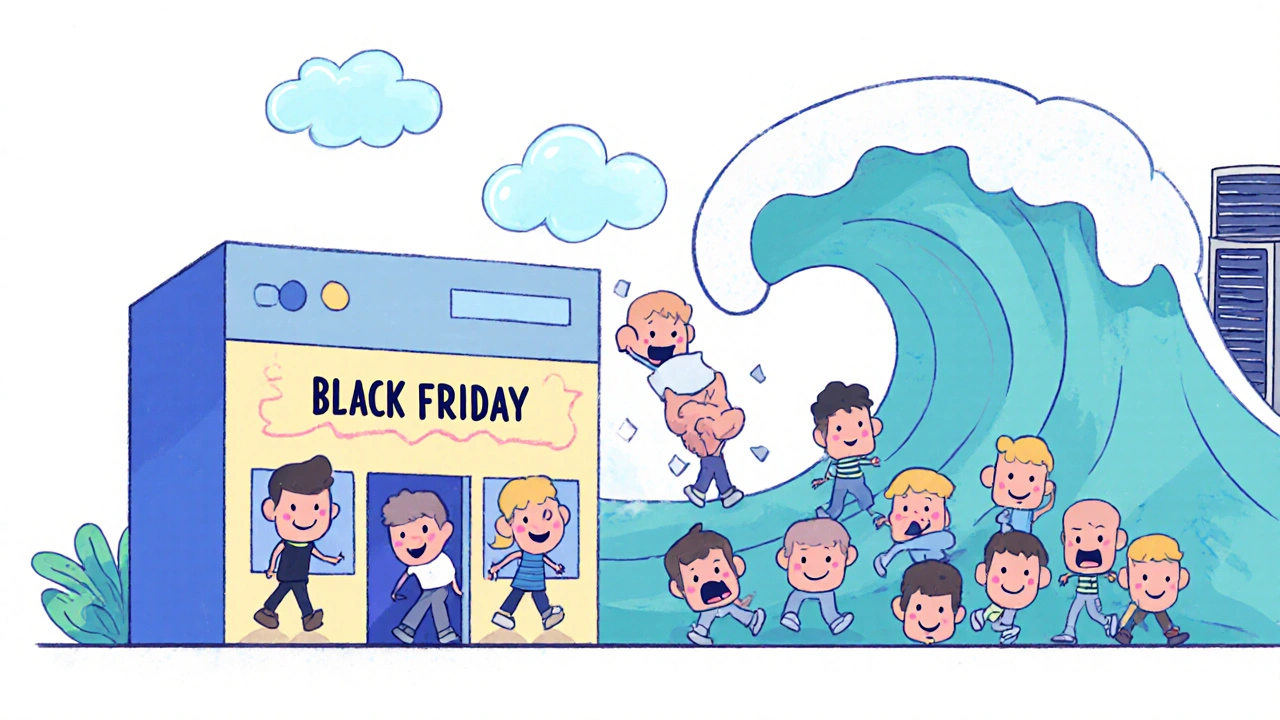

Behind the scenes, cloud scaling relies on automated tools that monitor usage and spin up or shut down servers in seconds. This isn’t just for big banks—it’s used by robo-advisors, BNPL services, and even nonprofit donation platforms. When Klarna sees a spike in buy-now-pay-later requests after Black Friday, cloud scaling kicks in so customers don’t hit error pages. When an NGO launches a new digital fundraising tool, cloud scaling ensures it doesn’t collapse under the load of sudden donations.

But scaling isn’t free. It requires smart architecture, careful cost control, and constant monitoring. Too little scaling, and you lose users. Too much, and you waste money on unused servers. That’s why companies track metrics like response time, error rates, and server utilization—not just traffic numbers. The goal isn’t to be the biggest, but to be just right: fast when needed, lean when it’s quiet.

You’ll find posts here that dig into how financial tech stays online under pressure—from automated compliance tools that scale with new regulations to trading platforms that handle flash crashes without blinking. You’ll see how cloud scaling connects to everything from RegTech costs to fintech resilience. These aren’t theory pieces. They’re real breakdowns of what works, what fails, and why it matters for your money.