Tactical Asset Allocation Calculator

Current Market Conditions

Input key market indicators to determine the current regime and recommended portfolio allocation.

Market Regime Analysis

Growth Regime

Strong equity performance with low volatility.

Recommended Allocation

70% Stocks (VTI, VXUS)

20% Bonds (BND)

10% Cash (SHV)

Stress Regime

High volatility or rapid yield changes.

Recommended Allocation

30% Stocks (VTI, VXUS)

50% Bonds (BND)

20% Cash (SHV)

Uncertainty Regime

Moderate volatility with flat stock performance.

Recommended Allocation

40% Stocks (VTI, VXUS)

40% Bonds (BND)

20% Gold (GLD)

No Regime Detected

Current indicators don't match any defined regime. Consider your strategic allocation.

Suggested Allocation

60% Stocks (VTI, VXUS)

30% Bonds (BND)

10% Cash (SHV)

How This Works

- Growth Regime VTI > 8% & VIX < 18

- Stress Regime VIX > 30 OR 10Y Yield Drop > 1%

- Uncertainty Regime VIX 20-30 & Flat Stocks (6 months)

Most investors stick to a fixed 60/40 portfolio-60% stocks, 40% bonds-and hope for the best. But what if the market shifts into a new phase? What if volatility spikes, interest rates climb, or recession fears take hold? A static portfolio doesn’t adapt. That’s where tactical asset allocation comes in.

What Tactical Asset Allocation Actually Does

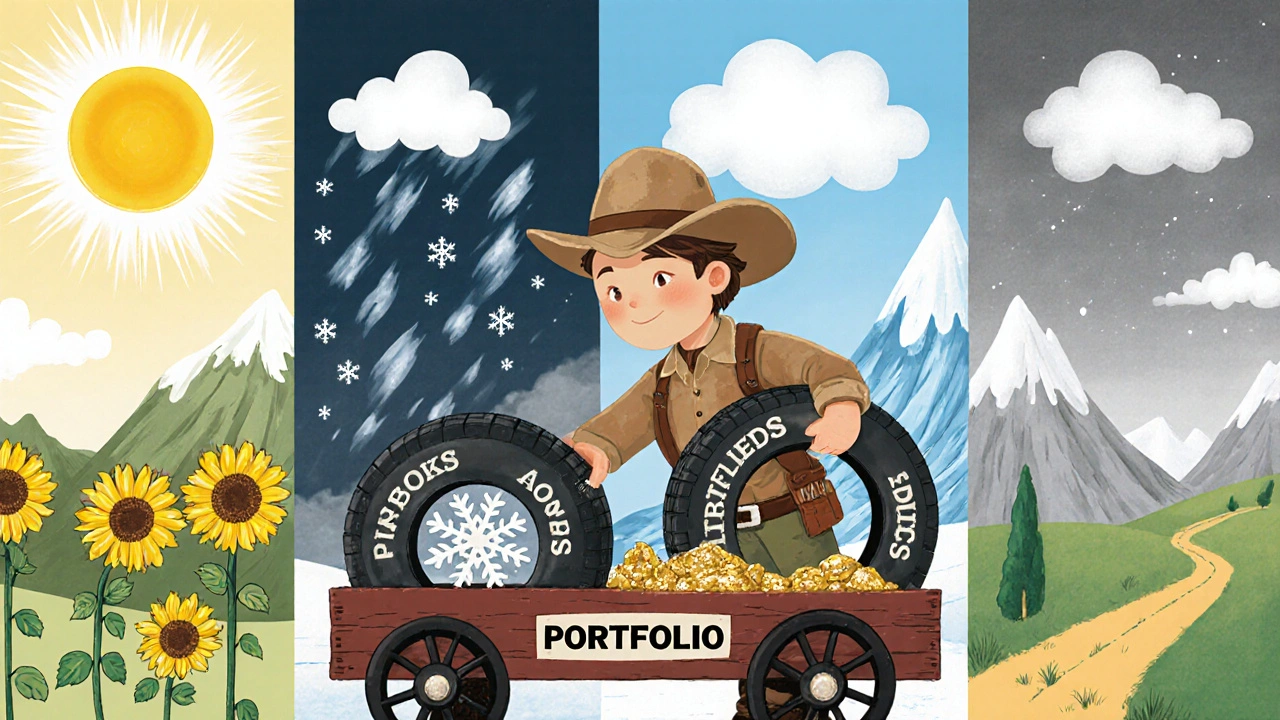

Tactical asset allocation (TAA) isn’t about timing the market. It’s about recognizing when the market’s behavior changes-and adjusting your portfolio to match. Think of it like switching tires based on weather. You don’t drive on snow tires in summer, and you don’t drive on summer tires in a blizzard. Markets have seasons too. Unlike strategic asset allocation, which locks in long-term targets (like 70% stocks, 30% bonds), TAA lets you tilt those weights based on current conditions. When the economy is growing and risk appetite is high, you might bump up equities to 75%. When fear dominates, you shift toward bonds, cash, or even gold. The goal? Capture more upside during bull phases and lose less during crashes. Data backs this up. Between 2000 and 2022, TAA strategies that used regime-based signals delivered 1.4% more annual return than plain buy-and-hold portfolios-with only 0.32 correlation to the S&P 500. That means they didn’t just move with the market; they moved smarter.How Market Regimes Work

A market regime is a sustained period where asset prices behave in a predictable way. There are four common ones:- Growth & Low Volatility: Stocks rise steadily, bonds perform well, VIX stays below 15. This is the “good times” phase.

- Stagflation: Inflation rises, growth slows. Stocks and bonds both drop. Commodities and TIPS shine.

- Recession & Deflation: Markets crash, yields fall, credit spreads widen. High-quality bonds and cash win.

- High Volatility & Uncertainty: No clear trend. Markets chop up and down. Momentum strategies struggle; defensive assets help.

Systematic vs. Discretionary TAA

There are two main ways to do TAA. Most institutional investors use the systematic version. Systematic TAA uses rules. For example:- If the 12-month momentum of U.S. equities is positive and VIX is below 20, allocate 70% to stocks.

- If the 10-year Treasury yield rises faster than GDP growth, shift 20% into short-duration bonds.

- If the credit spread between BBB and Treasuries widens by 50+ basis points, move into cash.

What TAA Can-and Can’t-Do

TAA isn’t a silver bullet. It works best under certain conditions. When TAA shines:- During sharp downturns like 2008 or 2020: TAA portfolios averaged 28% drawdowns vs. 51% for S&P 500.

- In high-volatility environments (VIX > 25): TAA outperformed strategic allocation by 1.8-2.3% per year.

- When trends are clear: Momentum-based signals worked consistently across 100+ years of data.

- In sideways markets: Between 2015-2016, TAA underperformed by 3.2% because signals kept giving false buy/sell cues.

- When fees are high: Turnover averages 150-300% annually. That’s 5-10x more trading than a buy-and-hold portfolio. Transaction costs and taxes can eat 0.25-0.75% per year.

- If you lack discipline: 78% of DIY investors abandon their rules during a crash. Then they buy high and sell low.

Real Results: Who Wins and Who Loses

Morningstar tracked 127 TAA funds from 2010 to 2022. Only 38% delivered statistically significant alpha after fees. The top 10% made 2.1% extra per year. The bottom 10% lost 1.3% per year. Why the huge gap? It comes down to three things:- Signal quality: Did they use real economic drivers or just noise?

- Cost control: Did they minimize trading?

- Backtesting rigor: Did they test their rules on data they never used to build them?

How to Implement TAA (Without a Quant Team)

You don’t need Python, a $200,000 data subscription, or a PhD to use TAA. Here’s a practical, low-cost version: Step 1: Pick your core assets. Use low-cost ETFs:- U.S. Stocks: VTI

- International Stocks: VXUS

- U.S. Bonds: BND

- Gold: GLD

- Cash: SHV (short-term Treasury ETF)

- Regime 1: Growth → If 12-month return of VTI > 8% AND VIX < 18 → 80% stocks, 20% bonds

- Regime 2: Stress → If VIX > 30 OR 10-year yield falls more than 1% in 30 days → 50% bonds, 30% stocks, 20% cash

- Regime 3: Uncertainty → If VIX is between 20-30 AND stocks are flat for 6 months → 40% stocks, 40% bonds, 20% gold

Common Mistakes to Avoid

- Overfitting: Don’t tweak your model until it looks perfect on past data. If it works too well on history, it’ll fail in real life. Test it on data you didn’t use to build it.

- Chasing performance: If your TAA strategy worked last year, don’t assume it’ll work this year. Regimes change.

- Ignoring costs: Every trade costs money. Use limit orders. Avoid ETFs with low volume.

- Emotional trading: If you feel anxious when the market drops, your system isn’t ready. Stick to the rules-even when it hurts.

The Future of TAA

Machine learning is making TAA more powerful. State Street’s MRI 2.0, launched in 2023, now reads Fed speeches and earnings calls using natural language processing. It’s 89.4% accurate at predicting regime shifts. But here’s the truth: technology doesn’t replace discipline. Even the best algorithm fails if you break the rules. Institutional investors now manage $3.2 trillion using TAA. By 2027, that number could hit $5 trillion. Retail investors are catching up too-robo-advisors now manage $185 billion in TAA portfolios. The key takeaway? TAA isn’t about beating the market. It’s about surviving it. When everyone else is panicking, you’re not fully invested. When everyone else is greedy, you’re not overexposed. That’s not genius. That’s just smart.Is TAA Right for You?

Ask yourself:- Do you have the patience to stick with a system for years-even when it underperforms for six months?

- Can you handle monthly check-ins without obsessing over daily swings?

- Are you willing to accept lower returns in calm markets to avoid big losses in bad ones?

What’s the difference between tactical and strategic asset allocation?

Strategic asset allocation sets fixed target weights-like 60% stocks, 40% bonds-and sticks to them long-term. Tactical asset allocation adjusts those weights based on current market conditions, like rising volatility or economic slowdowns. Strategic is about staying the course. Tactical is about adapting to the weather.

How often should I rebalance my tactical portfolio?

Monthly is ideal for most investors. Too frequent (daily or weekly) increases trading costs and triggers noise. Too infrequent (quarterly or yearly) misses timely shifts. Monthly checks let you respond to regime changes without overtrading.

Can I use TAA with index funds or ETFs?

Yes-ETFs are perfect for TAA. They’re low-cost, liquid, and track broad asset classes. Use VTI for U.S. stocks, VXUS for international, BND for bonds, GLD for gold, and SHV for cash. Avoid actively managed mutual funds-they come with high fees that kill TAA’s edge.

Does TAA work in bear markets?

It works best in bear markets. Historical data shows TAA portfolios limited losses to 28% during the 2008 crash, compared to 51% for the S&P 500. By shifting to bonds and cash when signals turn negative, TAA reduces drawdowns significantly.

Why do so many TAA strategies fail?

Most fail because they’re overcomplicated, too expensive, or emotionally driven. Backtesting on the same data used to build the model leads to false confidence. High turnover eats returns. And when markets turn volatile, investors abandon their rules. The winners stick to simple, low-cost, rules-based systems and stay disciplined.

What’s the ideal percentage of my portfolio to allocate to tactical adjustments?

Most experts recommend 15-25%. That’s enough to make a meaningful difference during market shifts, but not so much that you lose the stability of your core strategy. Think of it as a safety valve, not the whole engine.

Okay but real talk-why are we still pretending 60/40 is a strategy and not just a nap? I’ve been running a VIX + 12mo VTI momentum system since 2021 and holy shit, the drawdowns just… evaporated. Got crushed in 2022? Nah. I was 60% bonds and 20% cash when everyone else was crying into their Roth IRAs. TAA isn’t fancy math-it’s just not being an idiot when the market screams "RUN."

Also, GLD in uncertainty regime? Chef’s kiss. Gold doesn’t sleep. It just waits.

PS: Stop overfitting. If your model needs a PhD to understand, you’re already losing.

Utterly incoherent. You cannot possibly be serious about suggesting a 15-25% tactical allocation as a "safety valve" while simultaneously advocating for monthly rebalancing based on VIX thresholds. This is not portfolio management-it’s algorithmic roulette with a side of confirmation bias.

The data you cite-83.7% regime identification accuracy-is meaningless without out-of-sample validation. State Street’s MRI is a proprietary black box; you’re not replicating it with VTI and SHV. You’re gambling with ETFs and calling it science.

And let’s not forget: 78% of DIY investors abandon their rules during a crash. You think you’re the 22%? You’re not. You’re the one who bought Bitcoin at 68k and sold at 18k because "it felt wrong."

Stick to strategic allocation. The market doesn’t reward cleverness. It rewards patience. And discipline. And the humility to admit you don’t know what’s coming next.

It is fascinating, is it not, how we have come to treat financial markets as if they were weather systems-predictable, cyclical, governed by laws we can discern with enough data and a few simple rules? Yet the human soul, far more complex than any VIX index, remains stubbornly irrational, and it is this irrationality that ultimately shapes the very regimes we seek to model.

I wonder, in our pursuit of mechanical precision, do we not risk becoming slaves to the very algorithms we designed to free us? The 15-25% tactical adjustment-so carefully calibrated-still assumes that we, the humans, will remain detached, calm, and obedient to the spreadsheet when the world burns.

And yet… I have seen friends who followed such systems, who stuck to their rules even as their neighbors sold everything in panic, and they emerged not richer, but wiser. Not because they timed the market, but because they did not let the market time them.

Perhaps TAA is not about winning more, but about losing less… and in a world where loss is inevitable, that is perhaps the only victory worth having.

Still, I would advise-do not begin with ETFs. Begin with silence. Sit with your fear. Write down why you are afraid. Then, and only then, write your rules. For the market does not care about your backtests. It only cares if you still believe in them when the lights go out.