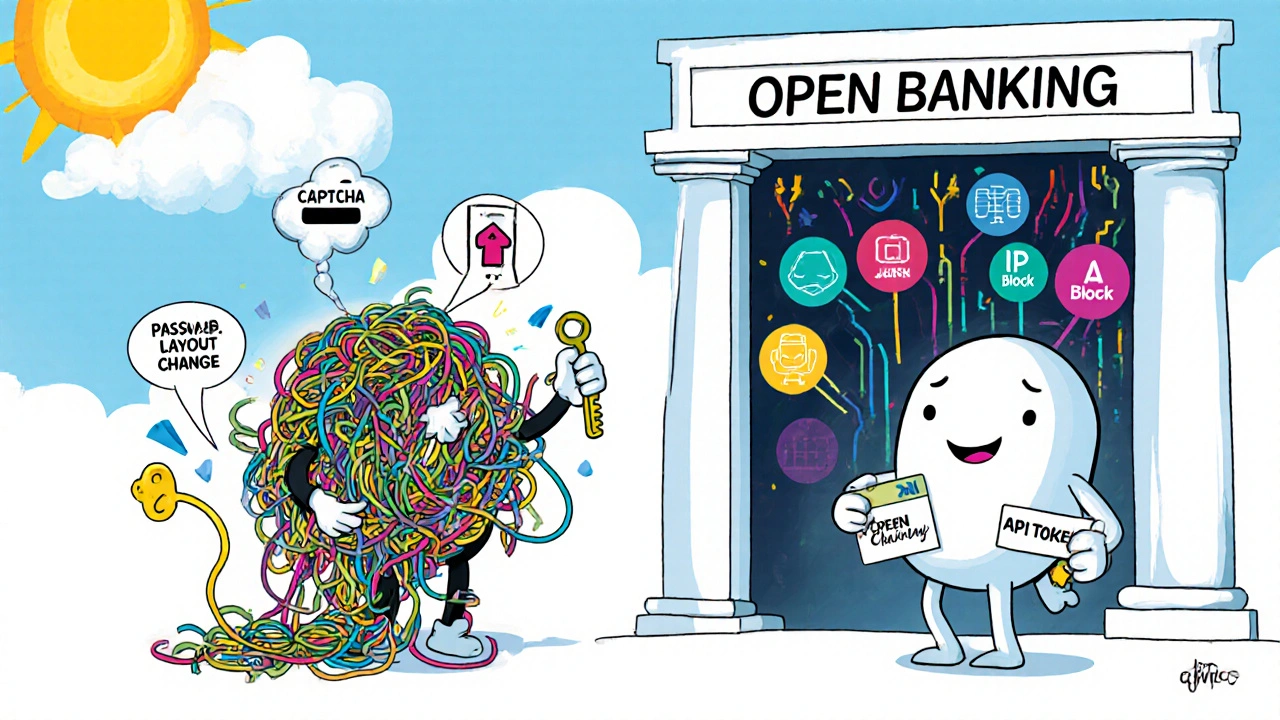

For years, apps like Mint and YNAB pulled your bank data by asking for your username and password. You typed them in, clicked "Allow," and the app magically showed your transactions. It felt harmless. But behind the scenes, those apps were screen scraping-automatically logging into your bank’s website like a human, reading the HTML, and stealing data from the page. It worked. Until it didn’t.

Today, that method is dying. Banks, regulators, and consumers are all pushing back. Why? Because sharing your login credentials with third-party apps is like giving a stranger a copy of your house key-and then letting them walk in whenever they want. It’s risky, unreliable, and increasingly illegal.

Why Screen Scraping Is a Security Time Bomb

Screen scraping isn’t just outdated-it’s dangerous. When you give your bank login to a finance app, you’re handing over the keys to your entire financial life. If that app gets hacked, your credentials are exposed. If the bank changes its website layout-which happens often-the app breaks. And if the bank detects automated login attempts, it locks your account.

According to the Financial Conduct Authority, 37% of financial data breaches in 2022 came from credential sharing. That’s not a small number. That’s a systemic failure. And it’s not just about theft. Users report account lockouts, failed syncs, and data errors. One Reddit user said their account got locked three times in a month because Mint’s screen scraping triggered security alerts. That’s not convenience-that’s chaos.

Screen scraping also struggles with modern web defenses. CAPTCHAs block 41% of scraping attempts. JavaScript-heavy banking sites break 67% of the time. IP addresses get blocked. Proxies and fake browsers are needed just to keep the scraper running. And even then, it’s fragile. Studies show 63% of screen scrapers stop working within 30 days after a website update. That’s not a system-it’s a house of cards.

The Rise of Secure APIs: How Open Banking Works

Enter APIs. Application Programming Interfaces. These are official, secure channels built by banks specifically for third-party apps to access your data. No passwords. No login pages. No HTML parsing.

Instead, you grant permission through a pop-up from your bank. You approve what data the app can see-like account balances or transaction history-and for how long. The app gets a temporary, limited-access token. That token expires in minutes. It can’t be reused. It can’t be stolen to log into your bank account. And if something goes wrong, you can revoke access instantly.

This isn’t theory. It’s law. In Europe, PSD2 forced banks to offer APIs by 2018. By 2023, 78% of European banks had fully shut down screen scraping. In the U.S., the Consumer Financial Protection Bureau (CFPB) called screen scraping an "unfair practice" in 2022. New rules under Section 1033-expected to finalize in late 2024-will make API access mandatory for major financial institutions.

Companies like Plaid, Akoya, and MX now connect to over 12,000 banks and credit unions via API. They don’t scrape-they connect. And it works better. Akoya’s data shows 99.98% uptime for API connections versus 87.4% for screen scraping. Response times? 450 milliseconds for APIs. Over 2,800 milliseconds for scraping. That’s a five-second wait versus a half-second. You feel the difference.

Reliability, Security, and Compliance: The API Advantage

APIs aren’t just faster-they’re smarter. They deliver structured data in clean JSON or XML format. No guessing where the account balance is on a webpage. No parsing messy HTML. No breaking when a button moves. Data is consistent, accurate, and predictable.

Security? APIs use OAuth 2.0-the same standard used by Google and Facebook for login. Tokens are short-lived, scope-limited, and encrypted. Credential exposure drops by 99.7% compared to screen scraping, according to Akoya’s security whitepaper. That’s why 100% of API-based connections meet GDPR and CCPA compliance. Screen scraping? Only 42% do.

And the numbers don’t lie. Plaid’s 2023 reliability report found API connections succeed 99.5% of the time in financial contexts. Screen scraping? Just 76.2%. Trustpilot reviews for API services average 4.3 out of 5 stars. Screen scraping tools? 2.8. And here’s the kicker: 78% of consumers say they’d switch apps if they found out it used screen scraping. Security isn’t a feature-it’s a dealbreaker.

The Hidden Costs of Screen Scraping

It’s easy to think screen scraping is cheaper. After all, tools like Scraping Robot charge pennies per page. But that’s the illusion.

Behind the scenes, developers spend 20 to 35 hours a week just keeping screen scrapers alive. They’re constantly updating selectors, bypassing CAPTCHAs, rotating IPs, and fixing broken layouts. One engineer told ScrapingBee: "I’m not building software-I’m playing whack-a-mole with bank websites."

APIs cost more upfront-initial integration takes 40 to 60 hours. But once set up, maintenance drops to 2 to 5 hours a week. No more chasing website changes. No more proxy farms. No more paying $1 per 1,000 CAPTCHAs to 2Captcha. The long-term cost of screen scraping isn’t in licensing-it’s in developer burnout.

And then there’s the legal risk. The CFPB’s 2022 Circular 2022-03 explicitly states that requiring users to share passwords is an unfair and deceptive practice. Fintechs using screen scraping are walking a legal tightrope. In 2024, major players like Intuit, Credit Karma, and Betterment publicly committed to eliminating screen scraping by December 2025. If you’re still using it, you’re already behind.

What About Banks Without APIs?

Yes, some smaller banks and credit unions still don’t have APIs. About 58% of community banks in the U.S. lack the resources to build them, according to a Federal Reserve study. That’s real. And yes, for now, some apps still rely on screen scraping to serve those customers.

But this is a transitional phase, not a permanent solution. The industry is moving fast. Plaid added 7,500 new bank connections via API since 2021. Akoya now connects to 1,200 institutions. Even if your bank doesn’t have an API today, they’re likely building one. The European Banking Authority has set a hard deadline: complete screen scraping elimination by June 2026. The U.S. is following.

And if your app still uses screen scraping for a small subset of users? That’s a liability. It’s not scalable. It’s not secure. And it’s not sustainable. The smart move isn’t to double down on scraping-it’s to plan for API adoption now, even if it means offering limited features until your bank catches up.

What You Should Do Now

If you’re a consumer: Check your finance app. Does it ask for your bank login? If yes, consider switching. Look for apps that say they use Plaid, MX, or Akoya. They’ll show you a pop-up from your bank-your bank’s official login page. That’s the sign of a secure connection.

If you’re a developer or fintech founder: Stop building new features on screen scraping. It’s a dead end. Start integrating with a financial data network like Plaid or Akoya. Even if your users’ banks don’t have APIs yet, these platforms have fallbacks and migration tools. Akoya’s "Sunset Screen Scraping" initiative has already helped 317 apps switch over. You don’t have to do it alone.

If you’re a bank or credit union: Don’t wait for regulators to force your hand. Build your API. Open banking isn’t coming-it’s already here. The banks that lead this transition will earn trust, reduce fraud, and attract fintech partners. The ones that delay? They’ll be left behind with outdated systems and angry customers.

The sunset of screen scraping isn’t a threat. It’s an upgrade. It’s the end of risky shortcuts and the beginning of real security. Your data belongs to you. It should be accessed with your permission-not stolen from a webpage.

Is screen scraping still legal?

Screen scraping is increasingly illegal in regulated financial environments. The U.S. Consumer Financial Protection Bureau (CFPB) declared in 2022 that requiring consumers to share login credentials is an unfair practice. In the European Union, screen scraping was banned for open banking under PSD2 regulations. While it may still be technically possible in some cases, using it puts companies at legal risk and violates consumer protection standards.

Why do some apps still use screen scraping?

Some apps still use screen scraping because their users’ banks haven’t built APIs yet-especially smaller credit unions or regional banks. It’s a temporary workaround. But as more banks adopt APIs and regulators tighten rules, this gap is closing fast. Major fintechs like Intuit and Betterment have committed to phasing out screen scraping entirely by late 2025.

What’s the difference between screen scraping and API access?

Screen scraping mimics a human user by logging into a website and extracting data from the page layout. It requires your username and password, breaks when websites change, and is easily blocked. API access uses official, secure channels built by banks. You grant permission through a pop-up, and the app receives structured data without ever seeing your login details. APIs are faster, more reliable, and far more secure.

Can I still use Mint or YNAB safely?

It depends. Mint still uses screen scraping for many banks, which is why users report account lockouts and sync failures. YNAB has transitioned to API-based connections for most institutions. Check your app’s settings or support page-it should say whether it uses Plaid, MX, or Akoya. If it asks for your password, consider switching to a service that doesn’t.

How do I know if my app uses an API?

When you connect your bank account, you’ll be redirected to your bank’s official login page-usually with your bank’s logo and secure URL (https://yourbank.com). If you’re typing your password into the app’s own screen, it’s screen scraping. If you’re logging in through your bank’s site, it’s API-based. Look for phrases like "Powered by Plaid" or "Secure connection via API" in the app’s documentation.

Are APIs more expensive for users?

No. API access doesn’t cost users anything extra. The fees are paid by the fintech companies, not the end consumer. In fact, because APIs are more reliable and require less maintenance, they often lead to better app performance and fewer disruptions. You get a smoother experience without paying more.

I switched from Mint to YNAB last year after my account got locked for the third time. The moment YNAB asked me to log in through my bank’s official portal instead of typing my password into their app, I felt like I could breathe again. No more ‘Oops, your bank changed their layout’ emails. No more frantic midnight checks to see if my transactions synced. It’s just… quiet. Reliable. And honestly? I didn’t even notice the transition until I realized I hadn’t had a single sync error in six months.

Bro, screen scraping is so 2015. Like, you’re telling me you’re still using a flip phone because ‘it works’? APIs are the new OAuth 2.0 + PSD2 + CFPB trifecta. Plaid’s not just a tool-it’s infrastructure. 99.98% uptime? That’s not a feature, that’s a covenant. And the data? Clean JSON, no parsing, no CAPTCHA roulette. Meanwhile, your ‘Mint’ is probably running on a 2017 Puppeteer script with a proxy farm and a prayer. Wake up. The future’s not coming-it’s already in your app’s settings under ‘Powered by Akoya.’

Oh wow. A whole essay on why we stopped being idiots. Groundbreaking. I mean, sure, I’m shocked that giving strangers your bank password was ever considered a ‘feature’ instead of a felony. But let’s be real-this isn’t innovation. It’s just the market finally catching up to basic cybersecurity hygiene. The fact that we needed a federal agency to tell us ‘don’t share your keys’ says everything about the last decade of fintech. Also, ‘78% of consumers would switch’? That’s not a trend. That’s a collective gasp of relief after realizing they’d been living in a phishing simulation for years. Congrats, industry. You’re now as secure as a 2010 Gmail account. Progress?