Donation Processing Cost Calculator

Input Your Details

Why This Matters

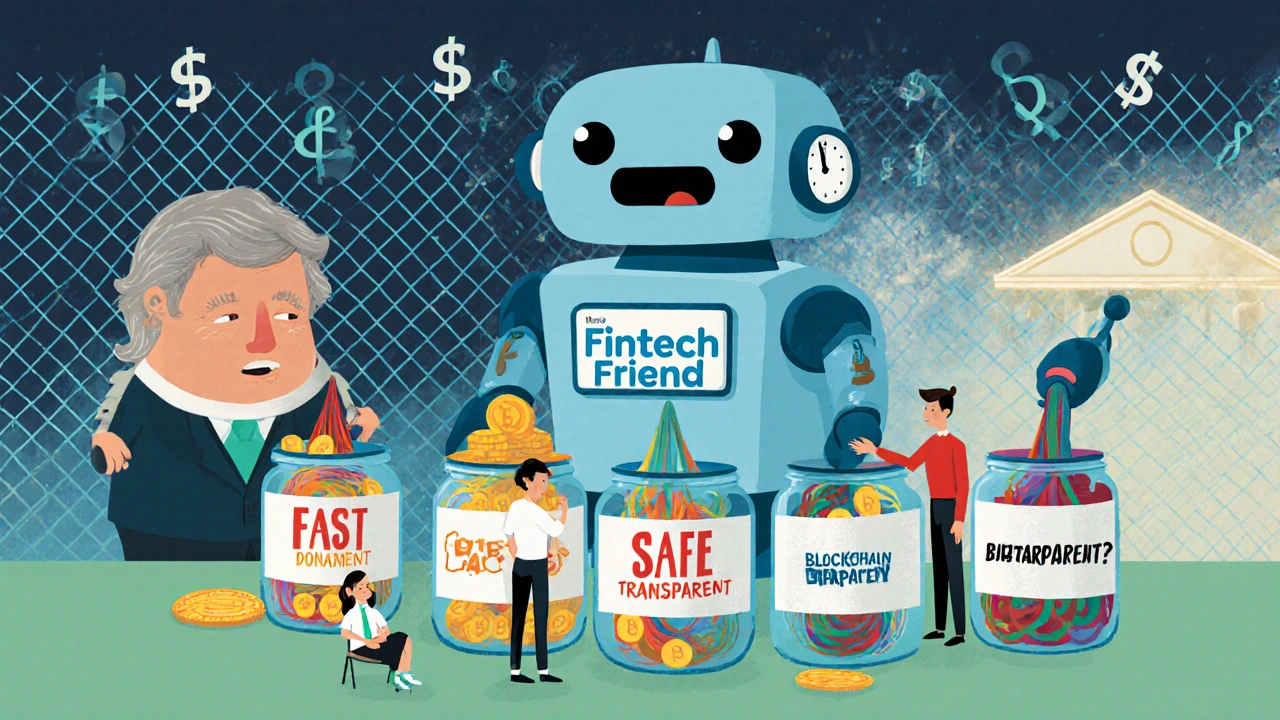

Traditional banks charge 1.8% per transaction while fintech solutions like Stripe charge 2.2% + $0.30. While fintech costs more per transaction, it offers critical benefits:

- ⏱️ 5.5 days processing time vs 1.7 days with fintech

- 🛡️ Advanced compliance tools to avoid account closures

- 🔍 Real-time transparency for donors

Results

Traditional Banking

Total annual fees: $0.00

1.8% processing fee on each transaction

Fintech Processing

Total annual fees: $0.00

2.2% + $0.30 per transaction

Nonprofits have always relied on donations to survive. But today, the way people give has changed-fast. Cash is fading. Bank transfers are slow. And regulators are watching closer than ever. For NGOs, the old way of handling money doesn’t cut it anymore. That’s why more nonprofits are teaming up with fintech companies-not to chase tech trends, but to survive.

Why NGOs Are Turning to Fintech

Back in 2019, Americans gave over $449 billion to charities. That’s a lot of money moving through systems built for the 1990s. Many NGOs still use banks that don’t understand their work. In fact, 44% of nonprofits had their accounts shut down between 2016 and 2021 because banks called them ‘high risk.’ Not because they were doing anything wrong-just because they didn’t fit the mold of a typical business.

Fintechs stepped in because they had to. They saw a gap: nonprofits needed fast, secure, transparent ways to collect and move money. And they needed it without getting flagged by anti-money laundering rules. Companies like Stripe, PayPal, and GiveLively started offering nonprofit-specific tools. These platforms don’t just process donations-they help NGOs track where money comes from, who gave it, and how it’s spent-all in real time.

Take the American Red Cross. In 2021, they added cryptocurrency donations through BitPay. It wasn’t about Bitcoin hype. It was about reaching younger donors who wanted to give in new ways. Crypto donations made up 0.8% of their $3.1 billion in annual giving. Small percentage? Yes. But it opened a door. And that door led to more people giving.

How Fintech Fixes the Biggest Problems

Let’s be honest: traditional banks are slow. Donations take 5.5 business days to clear. With fintech, that drops to 1.7 days. That’s not just convenient-it’s life-saving. When the Pakistan floods hit in 2022, one international NGO cut their fund approval time from 14 days to just 4.5 days using a fintech platform. That meant aid got to people faster.

Another big win? Transparency. Blockchain tools are now being used to track disaster relief funds. The Red Cross saw a 40% improvement in donor trust after using blockchain to show exactly where every dollar went. Donors don’t just want to give-they want to know their money isn’t disappearing into a black hole.

And compliance? That’s where fintech really shines. AI-powered systems can scan 10,000 transactions per second and spot suspicious patterns with 98.7% accuracy. These tools flag things like duplicate donations, unusual donor locations, or sudden spikes in small gifts-all red flags regulators watch for. NGOs used to hire expensive consultants to handle this. Now, software does it automatically.

The Real Cost-Not Just Money

It’s not all smooth sailing. Fintech solutions cost money. Stripe charges 2.2% + $0.30 per transaction. For small NGOs, that adds up. A $100 donation nets $97.50. Traditional merchant services might charge 1.8%. That difference matters when you’re living hand-to-mouth.

Then there’s integration. Most nonprofits still use old accounting software like QuickBooks Nonprofit or Blackbaud. Connecting those to a modern fintech platform isn’t plug-and-play. It takes time, tech skills, and often outside help. One NGO spent $187,000 and 9 months to get their system running. That’s not cheap.

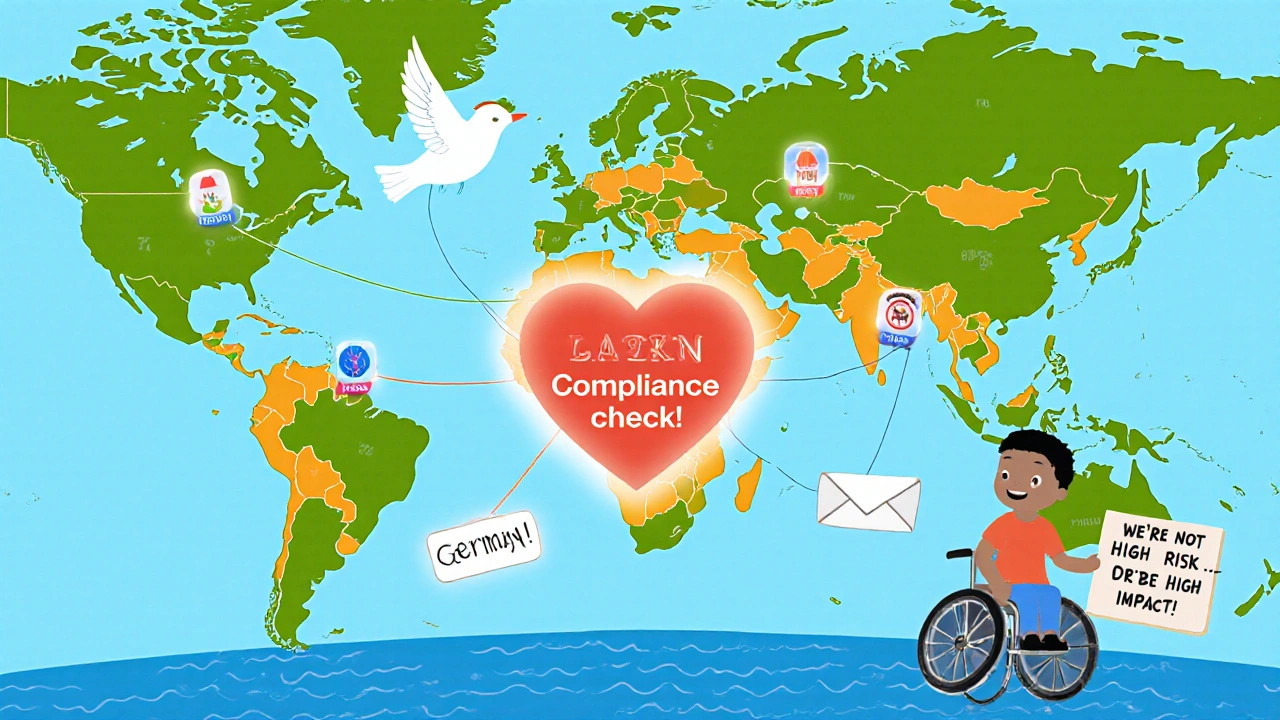

And international work? That’s the hardest part. AML rules change by country. What’s allowed in Kenya isn’t allowed in Germany. Fintechs aren’t regulators-they’re tools. If your platform doesn’t support multi-currency or local compliance rules, you’re on your own. One nonprofit leader on Reddit said, ‘We thought our fintech partner had it covered. Turns out, we had to hire a lawyer in three countries just to make sure we weren’t breaking the law.’

Who’s Winning-and Who’s Getting Left Behind

Size matters. Big NGOs with budgets over $50 million? 82% have fintech partnerships. Small NGOs under $1 million? Only 37%. Why? Because the upfront cost and complexity are too high. A $75,000 annual compliance package is a luxury for a group running on $800,000 a year.

But things are shifting. Platforms like GiveButter and GiveLively are building simpler, cheaper options. GiveButter processed $2.1 billion in donations in 2022-mostly from small to mid-sized nonprofits. They’re making it easier to set up a donation page in minutes, not months.

And then there’s the new wave: fintechs focused on financial inclusion. In July 2023, the UN partnered with 12 fintech companies to build tools that help 1 billion women-who’ve been locked out of banking-access credit, savings, and insurance. These aren’t just donation platforms. They’re building financial lifelines.

What You Need to Know Before You Sign Up

If you’re thinking about partnering with a fintech, here’s what to ask:

- Do they have a nonprofit-specific product? Not just a generic payment processor.

- Can they handle your country’s AML/CFT rules? Ask for proof, not promises.

- What’s the integration process? Will you need to hire a developer?

- How much training do they offer? Staff need to understand the new system.

- What happens if your donation volume spikes? Can the system handle it?

Don’t skip the documentation. Stripe’s nonprofit guides get 4.7 out of 5 stars. Many compliance platforms? Only 3.2. Good documentation saves headaches later.

The Future Is Here-But It’s Not Perfect

By 2026, Gartner predicts 65% of nonprofit fintech tools will come from just three big players: Stripe, Blackbaud, and Salesforce. That means less choice-but more reliability. Niche players will still exist, but they’ll serve specialized needs like blockchain transparency or gender-focused finance.

Regulators are watching. The Consumer Financial Protection Bureau opened 17 investigations in 2023 into fintechs that might be unfairly blocking donations based on algorithmic bias. That’s a warning: tech isn’t neutral. If your system rejects donations from certain zip codes or names, you’re risking more than compliance-you’re risking trust.

And here’s the truth: fintech won’t fix everything. It won’t replace the need for good leadership, ethical practices, or deep community ties. But it can free up time, reduce errors, and give donors confidence. For NGOs, that’s not a luxury. It’s survival.

Are fintech partnerships safe for NGOs?

Yes-if you choose the right partner. Fintechs designed for nonprofits follow strict AML/CFT rules and often have better security than traditional banks. But not all fintechs are equal. Look for platforms with clear compliance documentation, third-party audits, and experience working with NGOs. Avoid ones that don’t explain how they handle donor data or flag suspicious activity.

Can small NGOs afford fintech tools?

Absolutely. Platforms like GiveLively, GiveButter, and Stripe for Nonprofits offer low-cost or even free options for small organizations. Some charge as little as 1.5% per transaction with no monthly fees. The key is starting simple: use a donation page first, then add compliance features as you grow. Don’t wait until you’re overwhelmed to act.

What’s the biggest mistake NGOs make with fintech?

Assuming the fintech company handles everything. Fintechs provide tools, not legal advice. If you’re sending money overseas, you’re still responsible for knowing local laws. Many NGOs get fined because they thought their platform was ‘compliant enough.’ Always double-check with a compliance expert, especially when expanding internationally.

Do I need blockchain for my nonprofit?

Not unless you’re handling large-scale disaster relief or donor-funded projects that require public tracking. Blockchain adds transparency-but also complexity and cost. For most NGOs, a clear audit trail in your fintech platform is enough. Save blockchain for when you’re ready to prove accountability at a global level.

How long does it take to set up a fintech partnership?

For simple donation processing, you can be live in under a week. But if you’re adding compliance monitoring, multi-currency support, or integration with legacy systems, plan for 6 to 9 months. Budget for staff time, training, and possibly a consultant. Rushing this leads to errors-and regulatory trouble.

Will fintech replace human donors?

No. Technology makes giving easier, but people still give because they care. Fintech helps you reach more people, respond faster, and show impact-but it doesn’t replace storytelling, relationships, or trust. Use tech to amplify your mission, not replace it.

It's fascinating how technology, in its most impersonal form, has become the quietest ally of human compassion. We speak of algorithms and compliance frameworks as if they're cold machines, but every transaction processed through these platforms carries the weight of someone’s hope-a mother in Nairobi sending her last rupees to feed her child, a student in Ohio donating their babysitting earnings because they believe in clean water. The fintech revolution isn't about efficiency; it's about dignity. When a nonprofit can move funds in 1.7 days instead of 5.5, it’s not just a metric-it’s a child receiving medicine before the fever spikes. And yet, we still treat this as a logistical problem, not a moral imperative. We optimize spreadsheets while forgetting the faces behind the numbers. Maybe the real innovation isn't in blockchain or AI, but in remembering that behind every donor ID is a heart that chose to care.

Let’s be real-fintech for NGOs is just SaaS with a conscience. Stripe’s nonprofit tier? It’s basically the same engine as their e-commerce one, just with a ‘Save the World’ sticker slapped on it. The 2.2% fee? That’s the tax on idealism. And don’t get me started on the integration nightmares. I’ve seen orgs spend six months on API hell while their food pantry runs out of rice. The real win isn’t the tech-it’s the fact that GiveButter and GiveLively are finally making it stupid simple for small orgs to just… accept money. No dev team needed. No compliance PhD required. Just a link. Sometimes the most disruptive tech is the one that doesn’t ask you to change your life to use it.

Small orgs just need a button. That’s it. :)